Advertisement

Advertisement

Record exports help shrink U.S. trade deficit

By:

WASHINGTON (Reuters) - The U.S. trade deficit narrowed sharply in April as imports declined, suggesting that trade could contribute to economic growth this quarter for the first time in two years.

By Lucia Mutikani

WASHINGTON (Reuters) – The U.S. trade deficit narrowed by the most in nearly 9-1/2 years in April as exports jumped to a record high, putting trade on course to contribute to economic growth this quarter.

The sharp decline reported by the Commerce Department on Tuesday reversed March’s surge and suggested that trade could be shifting back to a more normal pattern. The deficit widened, hitting successive all-time highs, as the United States’ economy led the recovery from the COVID-19 pandemic global downturn.

The lingering pandemic and supply chains dislocations have caused extreme volatility in the trade data.

“The deficit has widened on trend over the past two years because the U.S. economy has generally grown faster than most of its major trading partners over that period,” said Jay Bryson, chief economist at Wells Fargo in Charlotte, North Carolina. “We look for trade to make a modest positive contribution to overall GDP growth in the second quarter.”

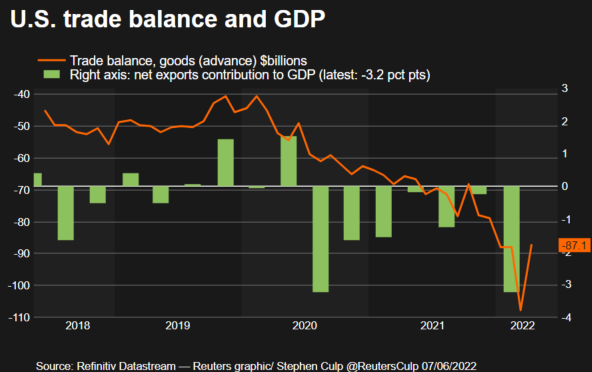

The trade deficit dropped 19.1%, the largest decline since December 2012, to $87.1 billion. Data for March was revised to show the trade deficit deteriorating to a record high of $107.7 billion instead of the previously reported $109.8 billion.

Economists polled by Reuters had forecast the trade gap shrinking to $89.5 billion. The government also revised trade data going back several years. Those revisions trimmed the previously reported estimates through the first quarter, which could see gross domestic product for that period revised up.

A record trade deficit chopped 3.23 percentage points from GDP in the first quarter, resulting in output contracting at a 1.5% annualized rate after growing at a robust 6.9% pace in the October-December quarter.

Following the revisions, economists expect first-quarter GDP will be revised to show it contracting at a rate of about 1.3% when the government publishes its third estimate later this month. Trade has subtracted from GDP for seven straight quarters.

Growth estimates for the second quarter are as high as a 4.8% rate. April’s trade deficit is about $7.5 billion below the average for the first quarter.

“If that level were to be maintained through June it would probably translate to a positive second-quarter GDP contribution of around two percentage points,” said Lou Crandall, chief economist with Wrightson ICAP in Jersey City.

Stocks on Wall Street were lower. The dollar slipped against a basket of currencies. U.S. Treasury prices rose.

Imports decline

In April, exports of goods and services increased 3.5% to an all-time high of $252.6 billion. The broad increase was led by shipments of industrial supplies and materials, which hit a record high amid rises in exports of natural gas, precious metals and petroleum products.

Petroleum exports increased to a record high of $27.2 billion from $26.3 billion in March. Food exports were also the highest on record, with the nation selling $2.1 billion more worth of soybeans. Capital goods exports increased $1.2 billion to $47.5 billion, the highest since March 2019, with civilian aircraft shipments rising $1.3 billion.

Exports of services increased $2.4 billion to $76.5 billion, lifted by gains in both travel and transport.

Imports of goods and services fell 3.4% to $339.7 billion. Imports had been rising rapidly as businesses replenished inventories to meet strong domestic demand.

But with the Federal Reserve raising interest rates to combat inflation, demand is slowing. Inventories of some goods are also close to normal levels, reducing the need for imports.

The drop in imports could also be the result of shutdowns in China as it battled new COVID-19 infections. Imports from China fell $10.1 billion, helping to narrow the goods trade gap with Beijing to $34.9 billion from $43.4 billion in March.

Consumer goods imports fell $6.3 billion, amid declines in textile apparel and household goods as well as toys, games and sporting goods. Pharmaceutical preparations also fell. Imports of industrial supplies and materials dropped $5.3 billion, with finished metal shapes plunging $5.6 billion.

Capital goods imports decreased $2.6 billion as computers fell $1.9 billion. But imports of motor vehicles, parts and engines increased $1.4 billion to an all-time high of $33.7 billion. Food imports were also the highest on record.

At $25.2 billion, petroleum imports were the highest since October 2014. With the United States now a net exporter of oil, the impact on the trade deficit was neutral.

Imported crude oil prices averaged $94.99 per barrel in April, the highest since August 2014.

Oil prices have surged in the aftermath of Russia’s war against Ukraine, which has also driven up prices of other commodities, including wheat and sunflowers.

“We would not be surprised to see some further moderation in imports as demand for goods softens,” said Veronica Clark, an economist at Citigroup in New York.

Imports of services increased $0.9 billion to a record $55.9 billion, lifted by travel and other business services.

(Reporting By Lucia Mutikani; Editing by Andrew Heavens, Chizu Nomiyama and Andrea Ricci)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement