- KORBIT

- OFFICIAL SITE

- Coins Available6Accepted Countries1Payment Methods1

KORBITReview

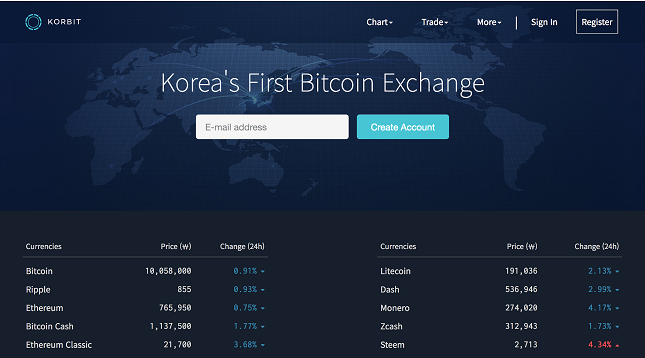

Korbit is a South Korean company which is heavily vested in the cryptocurrency market. The brand is owned and operated by Korbit Inc, a company located in Gangnam-gu, Seoul, South Korea. The brand commenced operations in 2014 after securing huge financing from several venture capitalists.

Korbit performs the following cryptocurrency-related services:

- Cryptocurrency trading for the local South Korean market.

- Fiat to cryptocurrency exchange services using the South Korean Won (KRW) as the fiat currency of choice.

Contents

- Regulations

- Reliability

- Exchange Platforms

- Instruments/Trade Types

- Account Types

- Fees

- Deposits and Withdrawals Options

- Bonus and Promotions

- Customer Support

- Pros and Cons

- FAQ

- Conclusion

South Korea has a large cryptocurrency trading market, which is largely populated by local players as well as companies who moved there when the Chinese ban on cryptocurrency trading came into effect. By providing the local and regional market the opportunity to use the local currency to purchase cryptocurrency tokens or to secure cryptocurrencies for trading purposes, Korbit is fulfilling a large need in that market.

Regulations

Cryptocurrency exchanges in South Korea are not regulated, although the government in that country are contemplating a move in this direction. So Korbit is not regulated.

Reliability

There is a lot of competition among South Korean exchanges when it comes to sourcing and maintaining customers, so all exchanges doing business there have to be at the top of their game in terms of reliability. Korbit is one of the reliable exchanges in South Korea.

Exchange Platforms

Korbit provides its customers with a web-based interface with which to carry out trading activities. What do Korbit customers get on using the web-based platform?

-

Korbit Web Platform

The web-based platform on Korbit features a separation of charting from the actual trade interface. This allows users to analyze the charts on one window, and execute their trades on another.

Users can also gain access to the order book, where the various market entries for traders on the platform are recorded. This can be used as a gauge of market sentiment, pointing to either a buy or a sell for the crypto concerned.

The charts come with basic tools of analysis. They are not comprehensive enough to perform a deep technical analysis. Traders may, therefore, have to resort to the use of external charting software if intense technical analysis with depth is to be performed.

-

Korbit Mobile Platform

Korbit does not provide a mobile app. However, the browser-based platform is properly optimized for use on mobile devices, and this is how smartphone and tablet users can operate on this platform.

Instruments/Trade Types

Korbit started off as a Bitcoin-KRW exchange site, but over time has expanded its asset base to include several other popular altcoins. So what digital assets are traded on Korbit?

- Bitcoin (BTC)

- Bitcoin Gold (BTG)

- Bitcoin Cash (BCH)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Dash (DASH)

- ZCash (ZCH)

- Monero (XMR)

- Augur

- Steem

- Ethereum Classic (ETC)

These digital assets can all be purchased as tokens with the South Korean Won (KRW), and can also be purchased as capital for crypto-crypto trading. The order types which are featured on the Korbit platform include:

- Limit orders (Buy/Sell)

- Stop orders (Buy/Sell)

- OCO (Order Cancels the Other)

- Market Buy/Sell

Account Types

All users of Korbit are given the same account type, irrespective of the volume of their transactions.

Fees

Korbit’s fees are the trading fees which traders incur on their transactions. These fees are known as the Maker-Taker fees. How do these fees work?

Every transaction has maker-taker fees, which are volume-based. In other words, the trading volume generated by each trader over a 30-day period determines the number of fees that are paid by them.

Maker fees are the fees paid by the traders who make a new trade entry in the order book. Taker fees are charged to traders who seek to enter at the best available entry price.

The trade volumes are denominated in South Korean Won.

| 30-day Trading Volume | Maker Fee | Taker Fee |

| < 100m KRW | 0.08% | 0.2% |

| >100m KRW but <200m KRW | 0.05% | 0.2% |

| >200m KRW but < 500m KRW | 0.03% | 0.2% |

| >500m KRW but < 2bn KRW | 0.02% | 0.2% |

| >2bn KRW but < 10bn KRW | 0.01% | 0.15% |

| >10bn KRW but < 30bn KRW | 0.00% | 0.1% |

| >30bn KRW but < 50bn KRW | 0.00% | 0.05% |

| >50bn KRW but < 100bn KRW | 0.00% | 0.02% |

| ➢ 100bn KRW | 0.00% | 0.01% |

Deposits and Withdrawals Options

The ability to use fiat currency on Korbit has a direct bearing on what deposit and withdrawal methods can be used on Korbit. It is possible to deposit using KRW, as well as with cryptos such as BTC, ETH, etc. Deposits and withdrawals can, therefore, be made as follows:

- Credit/debit card: The charges for use of credit/debit cards can be quite high. Users need to be aware of this.

- Bank transfers using KRW.

Bonus and Promotions

Korbit does not offer any bonuses, and there are no promotional campaigns. The reason may be that such campaigns are generally frowned on in Asian markets.

Customer Support

Customer support on Korbit is only available via phone and email. Details are as follows:

- Email: info@korbit.co.kr

- Phone: 1661-9707

Pros and Cons

Pros

- Korbit is widely accepted by its users and there have been no scam complaints.

- The platform is bilingual, featuring Korean and English languages.

- Login, deposits, and withdrawals are protected using 2-factor authentication.

- Provides ability to buy cryptocurrencies with the local fiat currency.

- Fees are moderate and the fee system rewards higher volume traders with lower fees.

- A clean user interface which is pleasant to the eye.

Cons

- The exchange seems to focus too much on the local South Korean market. It is not suitable for international users.

- Restricted asset base means only few crypto assets can be traded.

- Charts feature only a few tools for analysis.

FAQ

Here are some of the most common questions that are asked about Korbit’s crypto trading service.

-

Is Korbit regulated?

No. Korbit is not a regulated cryptocurrency exchange.

-

Where is Korbit based?

Korbit is based in Seoul, the capital city of South Korea.

-

How does Korbit make money?

Korbit charges market maker and taker fees for each trade transaction.

-

How do I deposit in Korbit account?

Korbit accepts cryptocurrency (ETH and BTC) and fiat deposits in South Korean Won.

-

How do I withdraw money from Korbit?

You can withdraw from Korbit using Bitcoin, Ethereum, and KRW.

-

Can I trade on Korbit with my mobile device?

Yes, you can use your mobile device to trade on Korbit. However, this is done on the browser-based, mobile-friendly platform and not through a mobile app.

-

Is Korbit reliable?

Korbit has proven to be a reliable and trusted exchange, especially as South Koreans are people who hold trust in very high esteem.

-

Is Korbit a scam?

No. Korbit is a very legit exchange and is not a scam.

Conclusion

Korbit was the first cryptocurrency exchange to offer the purchase of cryptos using fiat currency in South Korea and has a strong venture capital backing. It has continued to maintain its quality service since it opened its doors to customers in 2014. However, our feeling is that the brand should start to think of global expansion since the cryptocurrency market has grown to be a worldwide phenomenon. Korbit is a great brokerage to trade with, but also needs to add a mobile app to enhance its usage.

KORBITFeatures

- Bitcoin

- Ethereum

- Bitcoin Gold

- Bitcoin Cash

- Ethereum Classic

- Ripple

- South Korea

Payment Method

| Exchange Details | Info |

|---|---|

| Headquarters Country | South Korea |

| Foundation Year | 2013 |

| Type | exchange |

| Trading Allowed | Yes |

Top Wallets

- Your capital is at riskRead Review

- Your capital is at riskRead Review

- Your capital is at riskRead Review