Advertisement

Advertisement

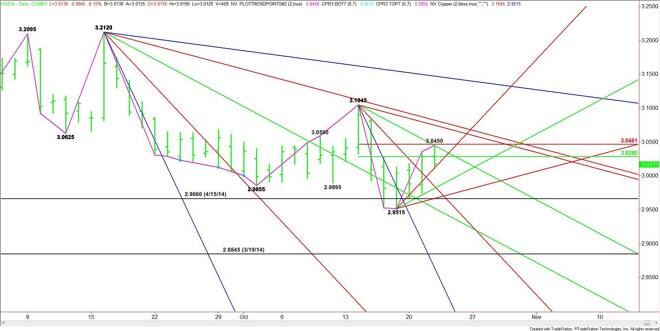

Comex High Grade Copper Futures (HG) Technical Analysis – October 23, 2014 Forecast

By:

December Comex High Grade Copper closed lower on Wednesday after slamming into resistance formed by a downtrending Gann angle and a Fibonacci level. This

The short-term range is 3.1045 to 2.9515. Its retracement zone at 3.0280 to 3.0460 stopped the rally yesterday. The close below the lower or 50% level at 3.0460 gives the market a downside bias today.

Also providing resistance was a downtrending angle from the 3.1045 top. This angle drops in at 3.0345 today.

On the downside, the first angle to watch is 3.0315. Since the market closed at 3.0175, today’s session essentially starts on the weak side of this angle. This could trigger a break into the next uptrending angle at 2.9915, followed by 2.9715. This is the last angle before the main bottom at 2.9515. Taking out this level will signal a resumption of the sell-off.

On the upside, taking out the Fibonacci level at 3.0460 that stopped the rally yesterday could trigger a further rally into a pair of downtrending angles at 3.0695 and 3.0770.

The tone of the market today will be determined by trader reaction to 3.0315. Since the close was below this angle, look for early downside pressure.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement