Advertisement

Advertisement

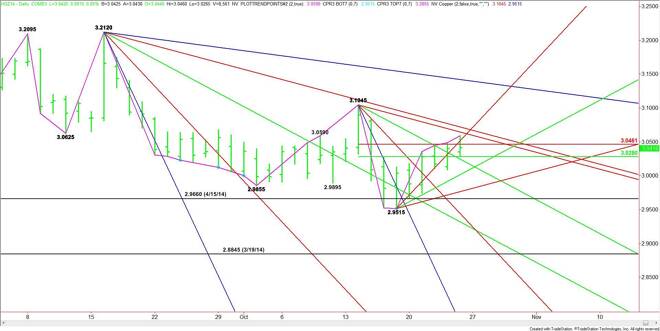

Comex High Grade Copper Futures (HG) Technical Analysis – October 27, 2014 Forecast

By:

December Comex High Grade Copper futures had a strong week. Friday’s close has put the market in a position to challenge the October 14 main top at

Standing in the way of the top at 3.1045 are a pair of short-term and long-term downtrending angles at 3.0595 and 3.0670. Overtaking these angles will put the market in a position to cross over to the bullish side of the nearest uptrending angle at 3.0715. Once this is accomplished then look for a drive into the main top at 3.1045.

The short-term range is 3.1045 to 2.9515. This zone is currently being tested. It is also controlling the short-term direction of the market. Bearish traders are trying to form a potentially bearish secondary lower top inside this zone while bullish traders are trying to use it as a launching pad to higher prices. Trader reaction to this zone may set the tone for the day and perhaps the week.

A sustained move over the Fibonacci level at 3.0460 will mean that buyers are coming in to support the market. Taking out the 50% level at 3.0280 will mean that sellers are winning the battle. On the downside, the first target is an uptrending angle at 3.0115, followed by 2.9815.

Look for a bullish tone over 3.0460 today and a bearish tone under 3.0280.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement