Advertisement

Advertisement

Crude Oil Bulls Seeing Few Clouds on the Horizon

By:

Brent crude oil trades back above $70/barrel for the first time in five months while WTI is attempting to re-enter the $65 to $75 range where it spent six months last year before the November to December collapse.

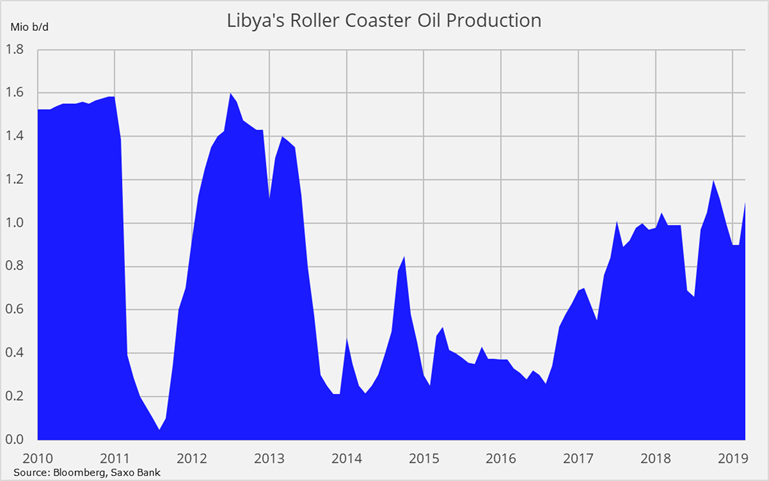

Supporting the latest move higher has been renewed concerns about supplies from Libya at a time where voluntary and involuntary production cuts from Opec and friends already have a firm grip on the market.

This update from Reuters shed some light on what is currently going on in Libya, a country which has seen dramatic ebbs and flows of its oil output since the fall of Gadaffi in 2011. A period of relative calm has seen Libya’s production move back above one million barrels/day. The major production sites are located far from Tripoli, the capital, where fighting is currently taking place. However, the confrontation between the UN-recognised government and Commander Haftar’s Libyan National Army (LNA) has raised the stakes and led to renewed concerns in the oil market.

The International Monetary Fund yesterday downgraded its global growth forecast to the lowest in ten years while Vladimir Putin raised doubts about Russia’s willingness to support a prolonged period of production cuts. But these developments are unlikely to hold any sway over the market as long Saudi Arabia continues to back the production cut deal as aggressively as it has done so far. With a very successful Aramco bond auction in the bag they will undoubtedly feel less inclined to act on renewed political pressure from the US.

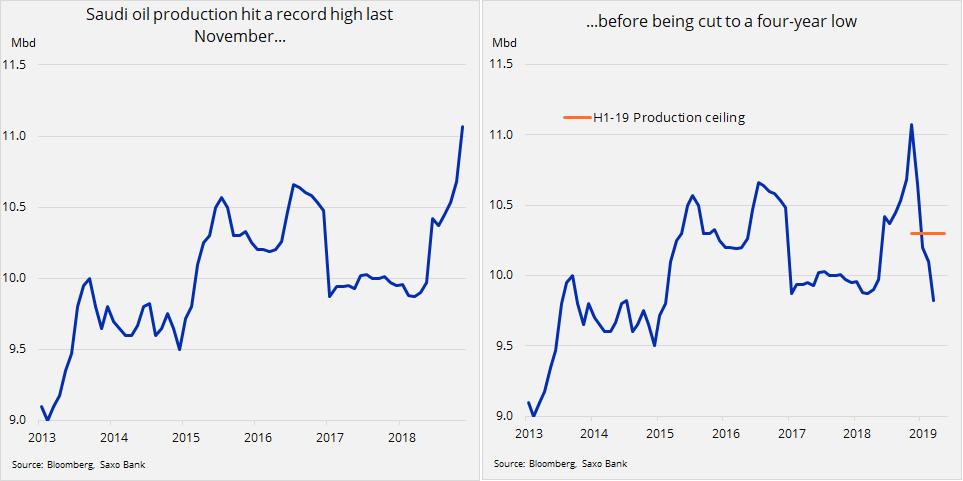

Following the murder of dissident journalist Jamal Khashoggi last year, the Saudis, in need of political friends abroad ,jumped when the US asked them to increase production ahead of the introduction of sanctions against Iran. What followed was the biggest slump in oil prices in years after the US surprisingly granted waivers to eight buyers of Iranian crude. As a result of being blindsided by the US and because of their need to support the price of crude oil, Saudi Arabia made a 180 degree turn: During a four-month period from December to March the kingdom’s production slumped from a record to a four-year low, well below the level they had agreed as part of the Opec+ deal to cut production.

With geopolitical risks continuing to impact production from Venezuela and Iran and now also potentially Libya and even Algeria, the crude oil market is likely to remain supported until the price reachs a level that is satisfactory for Opec and Russia. President Trump put through a call to the Saudi Crown Prince Mohammed bin Salman yesterday to discuss Saudi Arabia’s critical role in ensuring Middle East stability while maintaining maximum pressure against Iran. With the Iran waivers due to expire on May 4 the oil market will be looking towards the US and the price of oil to gauge how aggressive Trump can afford to be at this stage.

With Trump being very focused on (high) stock market prices and (low) gasoline prices the fact that US consumers are now paying the highest seasonal price for gasoline since 2014 could potentially limit his ability to tighten the screws on Iran.

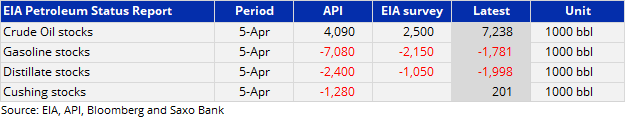

Later today at 14:30 GMT (CET+2 and ET-4) the EIA will publish its Weekly Petroleum Status report with the API and surveys both pointing to an increase in crude oil stocks and a continued drop in products.

Monthly oil market reports from Opec today (just published today) and the IEA tomorrow will further cast some light on these two major forecasters’ views on production and demand going forward.

According to a Bloomberg news story today, the Opec update confirms market expectations of a plunge in last month’s crude output, with the impact of planned cutbacks exacerbated by the political crisis in Venezuela. Opec oil output, it said, tumbled by 534,000 barrels a day to just above 30 million a day in March. It added that “If output remains at current levels, global oil inventories will decline sharply this quarter and next.”

This article is provided by Saxo Capital Markets (Australia) Pty. Ltd, part of Saxo Bank Group through RSS feeds on FX Empire.

About the Author

Ole Hansencontributor

Ole Hansen joined Saxo Bank in 2008 and has been Head of Commodity Strategy since 2010.

Advertisement