Advertisement

Advertisement

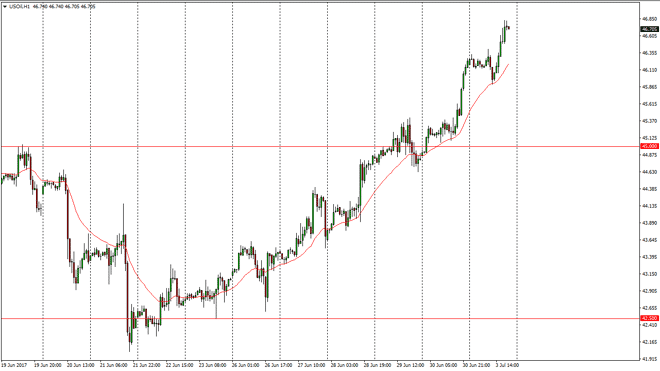

Crude Oil Price Forecast July 4, 2017, Technical Analysis

Updated: Jul 4, 2017, 04:44 GMT+00:00

WTI Crude Oil The WTI Crude Oil market went sideways initially during the day on Monday, but found the 24-hour exponential moving average supportive

WTI Crude Oil

The WTI Crude Oil market went sideways initially during the day on Monday, but found the 24-hour exponential moving average supportive enough to turn things around and reach towards the $46.85 level. It looks as if the market is trying to pull back a little bit, but I think given enough time we should continue to reach a little bit higher. Longer-term, I still am waiting for a resistive daily candle that I can start selling but we don’t have it yet. However, I think that once we get the exhaustive candle the market will probably turn around and reach towards the $45 level. Keep in mind that the Americans are celebrating Independence Day today, and that will of course have a massive effect on the oil markets. Because of that, a significant move may not happen today, but if we can break down below the $45 level, the market should continue to go much lower, perhaps reaching towards the $42.50 level after that.

Crude Oil Video 04.7.17

Brent

Brent markets rallied as well, but ran into a bit of resistance at the $49.50 level, and I think that the market will find even more resistance just above at the $50 handle. Given enough time, I am waiting to see some type of exhaustive daily candle, and I will sell this market as soon as it appears. The $50 level above offers a significant amount of resistance, so I think that the sellers will come back a relatively soon. A breakdown below the $47 level census market to the $45 level after that. No matter what happens, oil continues to be massively oversupplied, and I think eventually that will have the sellers jumping into this market, pushing prices longer-term to the downside.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement