Advertisement

Advertisement

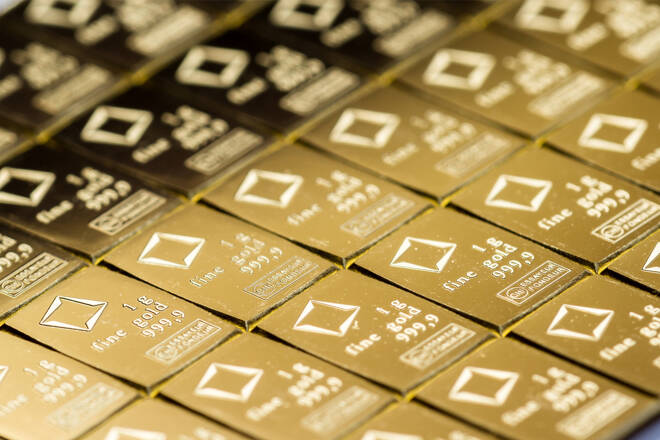

Daily Commodities: Gold Stays Close To The Key $1800 Level

By:

Meanwhile, copper markets continue to recover despite fears about the slowdown of the world economy.

Key Insights:

- WTI oil is mostly flat, but bulls may try to push it higher ahead of the weekend.

- Gold remains stuck near the $1800 level.

- Copper markets stay strong despite recession fears.

Oil

WTI oil continues to rebound from recent lows, and it may try to gain additional upside momentum ahead of the weekend.

Yesterday, OPEC released its monthly oil market report. World oil demand growth in 2022 was revised downwards. Interestingly, this revision did not put any pressure on oil markets, and it looks that some traders believe that the slowdown of the world economy is already priced in.

Meanwhile, Brent oil is trying to settle back above the psychologically important $100 level. Rising natural gas and coal prices highlight energy scarcity and provide material support to oil markets.

In this environment, oil may have a good chance to gain additional upside momentum ahead of the weekend.

Gold

Gold prices remain stuck near the $1800 level. The recent attempts to settle above this level were not successful, but there was no sell-off.

The recent pullback of the U.S. dollar provided material support to gold markets. The dynamics of the American currency will continue to serve as one of the key drivers for gold.

Today, gold traders should keep an eye on the Consumer Sentiment report from the U.S., which may have an impact on DXY. At the same time, it should be noted that it is not clear whether gold is ready for big moves ahead of the weekend.

Copper

The upside trend in copper markets remains strong. Currently, copper is trying to settle above the 50 EMA.

RSI remains in the moderate territory, so copper has a decent chance to gain solid upside momentum in case prices manage to stay above the 50 EMA.

Interestingly, recession fears had no impact on copper markets in recent weeks. Copper was oversold, and the market continues to recover after the major panic.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Vladimir Zernovauthor

Vladimir is an independent trader, with over 18 years of experience in the financial markets. His expertise spans a wide range of instruments like stocks, futures, forex, indices, and commodities, forecasting both long-term and short-term market movements.

Advertisement