Advertisement

Advertisement

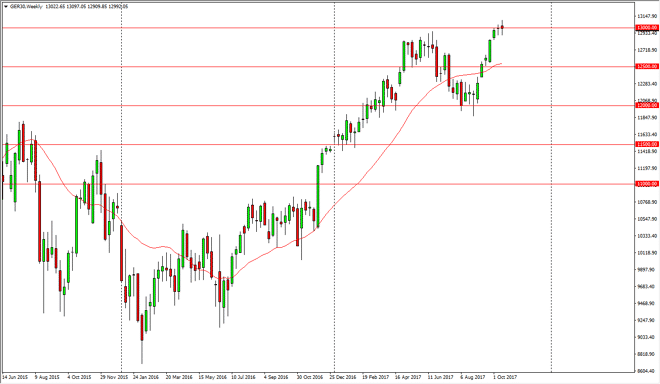

DAX Index forecast for the week of October 23, 2017, Technical Analysis

Updated: Oct 21, 2017, 07:36 GMT+00:00

The German index went back and forth during the week, dancing around the €13,000 level. The market has formed a relatively neutral candle, but at the end

The German index went back and forth during the week, dancing around the €13,000 level. The market has formed a relatively neutral candle, but at the end of the day I think it’s more or less a bullish candle because it shows that the market is trying to get comfortable in this area. The market should continue to find buyers underneath, as the recent breakout showed so much in the way of strength. We have also recently had an impulsive move, so it makes sense that we may have to pull back a bit to take advantage of built up strength, and value that would appear on that pullback. I believe that the €12,500 level underneath is massively supportive, and essentially the bottom of the market.

Under a long enough timeline, I believe that the market goes towards the €15,000 level, which of course is a large, round, psychologically significant number. Ultimately, I believe that this market may bounce around in this general vicinity to build up the necessary momentum, but I think longer-term that’s where we are going. This will be especially true if the EUR/USD pair continues to find a bit of softness as it has seen as of late, as it helps with German exports. Keep in mind that the European Union economy has been doing better as of late, so quite frankly I think there are a multitude of reasons why this market should go higher. Having said that, we are bit overstretched, so it wouldn’t be a huge surprise to see the market pull back and that’s essentially what I’m counting on. Alternately, if we broke above the €13,200 level, I would have to go ahead and start buying this market as it would clearly be ready to go even higher.

DAX Video 23.10.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement