Advertisement

Advertisement

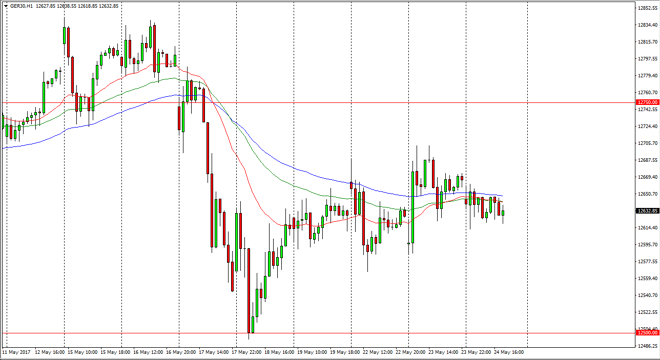

DAX Index Price Forecast May 25, 2017, Technical Analysis

Updated: May 25, 2017, 03:50 GMT+00:00

The German index gapped lower at the open on Wednesday, but only slightly so. Because of this, the market is essentially sitting sideways, as the €12,650

The German index gapped lower at the open on Wednesday, but only slightly so. Because of this, the market is essentially sitting sideways, as the €12,650 level is between 2 major areas on the chart. We are essentially in “no man’s land”, and because of that I think it’s difficult to place a trade at this level. Longer-term, I still believe in the uptrend, as the DAX tends to attract more money than the other indices in the European Union. After all, it is the “blue-chip stocks index” of the European Union. With this in mind, I still have a long bias but I recognize that the market could pull back significantly from here. I think supportive candle’s offer buying opportunities, but quite frankly there isn’t much on this chart to excite me currently.

The case for support below

Several sessions ago, the market fell apart and reached towards the €12,500 level, where we promptly saw a lot of buying. That significant bounce tells me that there are plenty of buyers out there still, so I have a longer-term bias in general. I think that the market will eventually go looking towards the €13,000 level, and if you are patient enough you could make money in this scenario. A break above €13,000 is very bullish, but I think we may have to wait a while for that. In the meantime, I believe short-term traders will continue to buy on the dips and support this market as it tends to lead the way for other European indices. Stock markets in general are doing fairly well, and as long as as the case, the DAX will certainly do the same as so many traders look at it as a proxy for the entire European Union, which seems to be doing better economically.

DAX Video 25.5.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement