Advertisement

Advertisement

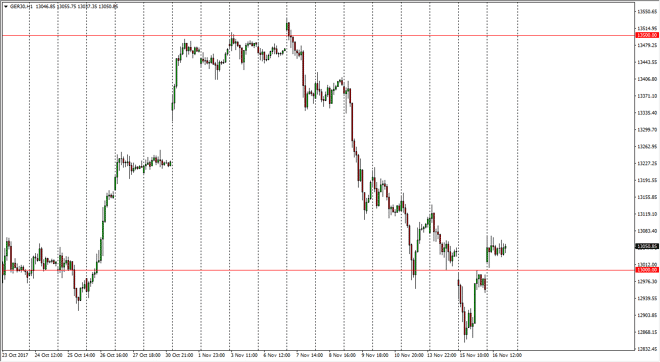

DAX Index Price Forecast November 17, 2017, Technical Analysis

Updated: Nov 17, 2017, 05:01 GMT+00:00

The German index gapped higher at the open on Thursday, clearing the €13,000 level. By doing so, and show signs of life again, and I believe it’s only a

The German index gapped higher at the open on Thursday, clearing the €13,000 level. By doing so, and show signs of life again, and I believe it’s only a matter of time before we go to the upside again. A break above the €13,150 level sends this market to the €13,250 level, and then eventually the €13,500 level. I believe that this market will continue to see buyers, because quite frankly Germany is the “blue-chip index” of the European Union. If the EUR/USD pair roles over a bit, that will help this market as well, as German exports become much cheaper.

Pay attention to stock markets in America, they can sometimes foretell where we are getting ready to go and Europe. That’s the same in the Nikkei as well, so if Japan rallies significantly, that could have a bit of a knock-on effect over here as well. I do believe in the DAX longer term, so I don’t have much interest in shorting, unless of course we were to make a fresh, new low in the market as it would show a pickup in downward momentum. However, breaking above the gap from a couple of sessions ago and the psychologically important level of 13,000 suggests to me that the buyers are starting to make a stand again.

Longer-term, I believe that investors will continue to pile money into the DAX, as it tends to attract a lot of attention and therefore should continue to be very bullish. If we were to break down, I suspect that not only the DAX would fall apart, but several other European indices would as well. If that’s the case, we probably have significant pressures and several other stock markets that we follow here at FX Empire, and it could be a general moved to the downside.

DAX Video 17.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement