Advertisement

Advertisement

Dow Jones 30 and NASDAQ 100 forecast for the week of December 25, 2017, Technical Analysis

Updated: Dec 23, 2017, 06:58 GMT+00:00

US stock markets rallied a bit during the week, but gave back most of the gains to form sell signals in both indices.

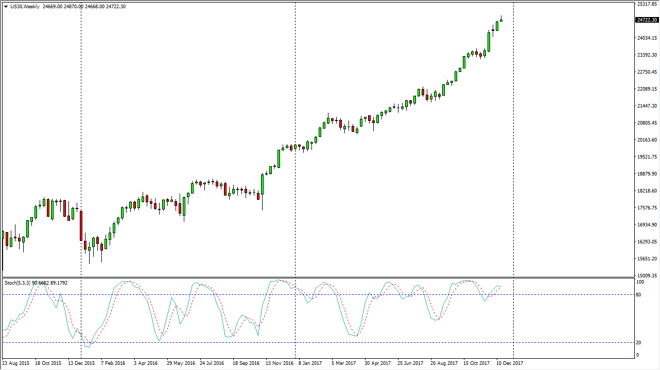

Dow Jones 30

The Dow Jones 30 initially rally during the week, but turned around to form a shooting star which of course is a sell signal. Because of this, I think we have gotten a bit ahead of ourselves, and it’s likely that we may have a bit of a pullback during the illiquid time between Christmas and New Year’s, but I think that eventually we will find buyers coming back into the marketplace looking for value. We could shed a few hundred points, but quite frankly that’s not a big deal in this market. We are crossing in the weekly stochastic oscillator overbought range, so I think there are several reasons to think that we are going to struggle. Longer-term though, I am very bullish of the Dow Jones 30.

Dow Jones 30 and NASDAQ Index Video 25.12.17

NASDAQ 100

The NASDAQ 100 rallied initially during the week, breaking above the vital 6500 level. But by the end of the week we ended up forming a shooting star at that level, which signifies that we’re probably going to go looking towards lower levels. I think that this isn’t some type of massive breakdown waiting to happen, I think it’s rather the market trying to find a bit of value and extend gains longer term. After all, markets can’t go in one direction forever, and the NASDAQ 100 has been a bit of a laggard when it comes to US stock indices. I’m a buyer of dips and anticipate that the 6000 level will be the absolute “floor” of the NASDAQ 100, but I also see a certain amount of support at the 6300 level. Alternately, if we break above the top of the shooting star that’s a bullish sign as well.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement