Advertisement

Advertisement

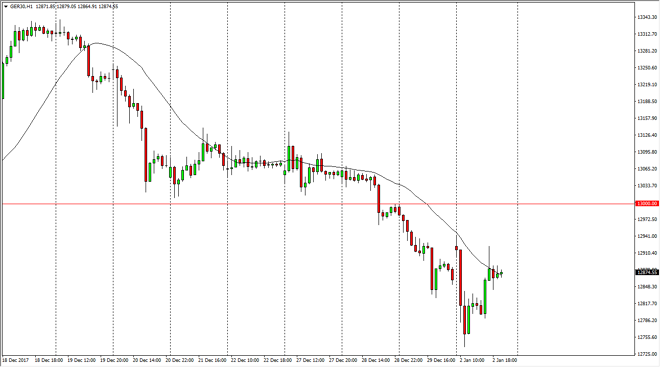

Dow Jones 30 and NASDAQ 100 Price Forecast January 3, 2018, Technical Analysis

Updated: Jan 3, 2018, 07:12 GMT+00:00

The German index gapped higher at the open on Tuesday, but found enough sellers to break down significantly. We found support near the €12,750 level though, and bounced back to fill the gap later. This is a market that continues to be very choppy, as we are at significant longer-term levels.

Dow Jones 30

The Dow Jones 30 initially tried to rally during the trading session on Tuesday, reaching towards the 24,850 handle, and then rolled over to wipe out most of the gains. I think that the market should continue to be choppy, and as we are close to the bottom of the short-term consolidation area, I would anticipate the buyers should return. For what it’s worth, the hourly stochastic oscillator has crossed in the oversold area, so there is at least the technical signal to start going long. I believe that the market will eventually go looking towards the 25,000 handle above, which of course has a massive amount of psychological significance built into it.

Dow Jones 30 and NASDAQ Index Video 03.01.18

NASDAQ 100

The NASDAQ 100 gapped higher at the open on Tuesday, but then fell to fill the gap. We have since exploded to the upside, gaining over 1000 points for the day. By breaking above the 6500 level, it shows that we are ready to continue the longer-term uptrend, and I believe that pullbacks at this point should be nice buying opportunities. Eventually, the market probably goes as high as 7000, but it’s going to take a long time to get there. I believe that every time we pull back, you should be adding slowly to your position, building up a large core position that can take advantage of what has been an explosive move to the upside and what has also seen quite a bit of buying pressure.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement