Advertisement

Advertisement

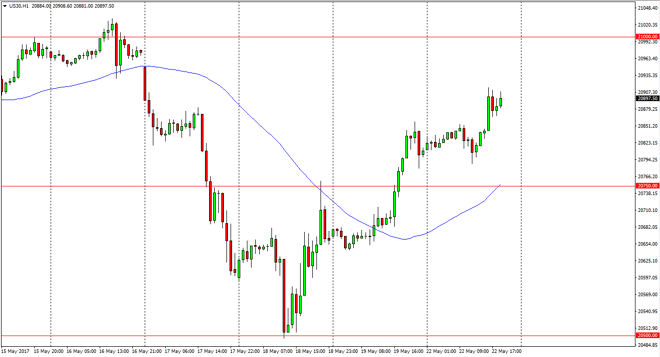

Dow Jones 30 and NASDAQ 100 Price Forecast May 23, 2017, Technical Analysis

Updated: May 23, 2017, 06:07 GMT+00:00

Dow Jones 30 The Dow Jones 30 had a bullish session as the Americans came back to work on Monday. By showing the strength and breaking above the cluster

Dow Jones 30

The Dow Jones 30 had a bullish session as the Americans came back to work on Monday. By showing the strength and breaking above the cluster of resistance at the 20,850 level, I think that the buyers are going to be coming back into the market when we dip on short-term charts. We have yet to fill the gap from 4 sessions ago, which sits at roughly 20,975. I don’t see the reason we don’t do that, and quite frankly I expect this market break out to fresh, new highs given enough time. I look at pullbacks as value in this market, especially near the 20,850 level, as earnings season has panned out reasonably well for a marketplace that is highly driven on a handful of blue-chip stocks. Once we break out to the upside, the market should continue its long grind higher.

Dow Jones 30 and NASDAQ Index Video 23.5.17

NASDAQ 100

The NASDAQ 100 continues to be one of the most bullish indices in the United States, as we approached the 5700 level during the session on Monday. There is a lot of noise in this area, so a pullback makes quite a bit of sense, but I think given enough time the buyers will return, especially near the 5675 handle. I also see significant support at the 5650 level, so I don’t have any interest in selling. A supportive candle underneath is exactly what I’m looking for, but if we break out above the 5700 level with a significant volume enforce, I’d be a buyer there as well. I don’t have any short interest, and I believe that the buyers are very much in control of what has been the most bullish index in the United States for some time.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement