Advertisement

Advertisement

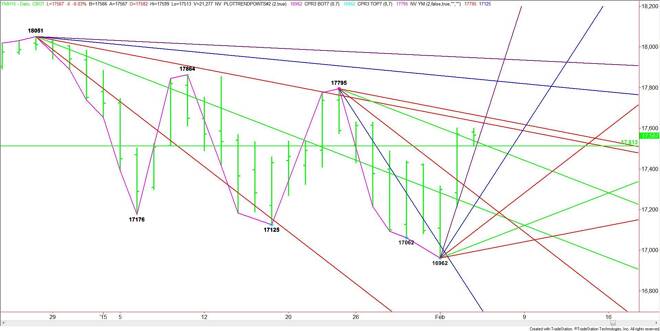

E-mini Dow Jones Industrial Average (YM) Futures Analysis – February 4, 2015 Forecast

By:

March E-mini Dow Jones Industrial Average futures are called lower this morning. Weaker oil prices are the catalyst behind the sell-off. Yesterday, the

March E-mini Dow Jones Industrial Average futures are called lower this morning. Weaker oil prices are the catalyst behind the sell-off. Yesterday, the Dow rallied sharply higher as traders turned on the “risk-on” switch.

The strong close put the Dow in a position to turn the main trend to up on the daily chart, but a pair of major downtrending angles at 17635 and 17667 are preventing this today. Taking out this angles will be a sign of strength. This could lead to a move through the last main top at 17795. This will change the main trend to up on the daily chart.

A trade through the downtrending angle at 17539 will be the first sign of weakness, but don’t look for an acceleration to the downside unless the uptrending angle at 17474 is taken out with conviction. This move could flush out the buyers with a trade to the next angle at 17218 a strong possibility.

The major range is 16974 to 18051. Its pivot at 17513 is controlling the long-term direction of the market. Trader reaction to this price could eventually determine the longer-term tone of the market. Continuing to straddle this level with closes below it will indicate distribution which is a bearish sign.

Generally speaking, look for a somewhat upside bias as long as support holds at 17539 to 17513. The market will turn extremely bullish if 17667 is taken out with conviction and extremely bearish under 17474.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement