Advertisement

Advertisement

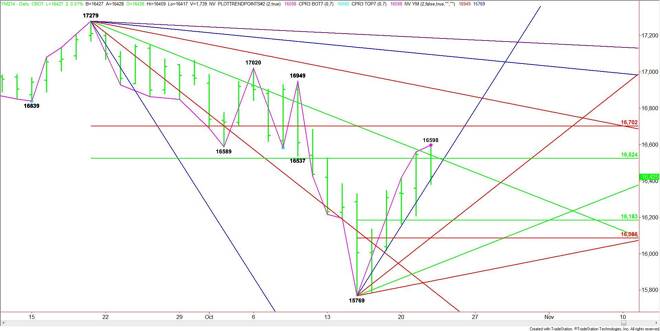

E-mini Dow Jones Industrial Average (YM) Futures Analysis – October 23, 2014 Forecast

By:

December E-mini Dow Jones Industrial Average futures closed lower on Wednesday, posting a potentially bearish closing price reversal top. A trade through

December E-mini Dow Jones Industrial Average futures closed lower on Wednesday, posting a potentially bearish closing price reversal top. A trade through 16383 will confirm the chart pattern.

The new range is 15769 to 16598. Its retracement zone at 16183 to 16086 is the primary downside target.

The main range is 17279 to 15769. Yesterday’s high at 16598 fell inside its retracement zone at 16524 to 16702. The selling inside this price zone wasn’t a surprise, but the timing was a little early. Usually the closing price reversal top occurs following a 7 to 10 day rally.

Adding to the developing bearish scenario was the close under a steep uptrending angle at 16537, a key 50% level at 16524 and a downtrending angle from at top at 17279.

Look for a bearish tone today as long as the Dow stays under 16537. Overcoming this angle could put the market in a positon to challenge the reversal top at 16598. Taking out this price will negate the potentially bearish chart pattern and could trigger a surge into the Fibonacci level at 16702.

A sustained move under 16383 could eventually lead to an acceleration to the downside with 16183 the minimum downside target.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement