Advertisement

Advertisement

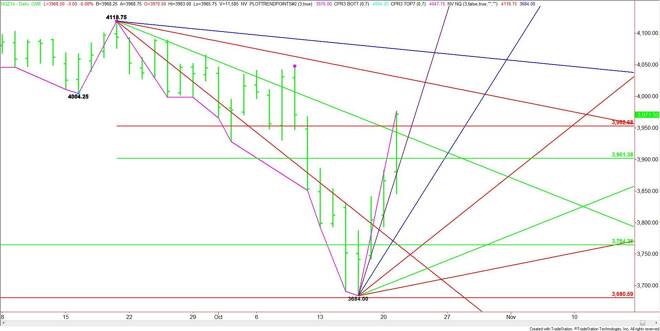

E-mini NASDAQ-100 Index (NQ) Futures Technical Analysis – October 22, 2014 Forecast

By:

December E-mini NASDAQ-100 Index futures surged on Tuesday, taking out a long-term downtrending angle from the contract high and a Fibonacci level. The

December E-mini NASDAQ-100 Index futures surged on Tuesday, taking out a long-term downtrending angle from the contract high and a Fibonacci level. The strong close near the high of the session puts the market in a position to follow-through to the upside.

The main range is 4118.75 to 3684.00. The retracement zone created by this range at 3952.75 to 3901.25 are new support levels.

A steep uptrending angle from the 3684.00 bottom passes through the retracement zone, making it valid support. An angle from the 4118.75 top drops in at 3934.75.

A sustained move over the Fibonacci level at 3952.75 will set a bullish tone today. The first upside target is a downtrending angle at 4026.75. Taking out this level could trigger a further rally into 4072.75.

Breaking back under 3952.75 will be the first sign of weakness. The next will be a move under the steep angle at 3940.00. Finally, crossing under the downtrending angle at 3934.75 will indicate increased selling pressure. This could lead to a break back to the 50% level at 3901.25.

The tone of the market today will be determined by trader reaction to 3952.75.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement