Advertisement

Advertisement

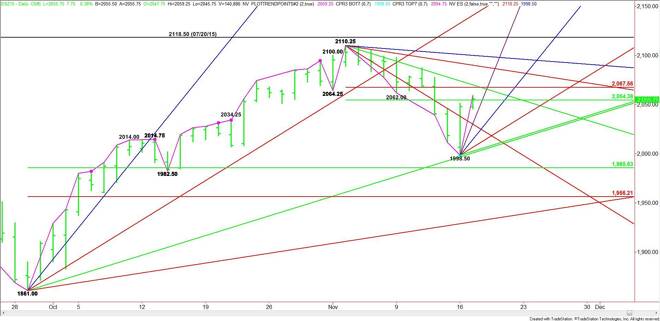

E-mini S&P 500 Index (ES) Futures Technical Analysis – November 17, 2015 Forecast

By:

December E-mini S&P 500 Index futures are trading higher shortly before the cash market opening. The index followed through to the upside after

December E-mini S&P 500 Index futures are trading higher shortly before the cash market opening. The index followed through to the upside after yesterday’s closing price reversal bottom, confirming the chart pattern. The rally also helped the market reach its first objective during the pre-market session so will have to see if the upside momentum will continue to take the index beyond this level.

The main trend is down according to the daily swing chart. However, momentum shifted to the upside with the formation of the closing price reversal on Monday.

The main range is 2110.25 to 1998.50. Its retracement zone and primary upside target is 2054.50 to 2067.50. The lower or 50% level at 2054.50 was tested earlier in the session.

Trader reaction to 2054.50 is likely to determine the direction of the market the rest of the session.

A sustained move over 2054.50 will signal the presence of buyers with the next target a Fibonacci level at 2067.50. This is followed closely by a downtrending angle at 2070.25.

The angle at 2070.25 may act like resistance on the first test, but it is also the trigger point for an acceleration to the upside with the next target another downtrending angle at 2090.25. The last angle before the 2110.25 main top comes in at 2100.25.

A sustained move under 2054.50 will indicate the presence of sellers. This could trigger a break into a pair of steep uptrending angles at 2030.50 and 2014.50.

Watch the price action and read the order flow at 2054.50 today. Trader reaction to this level will tell us whether the bulls or the bears are in control.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement