Advertisement

Advertisement

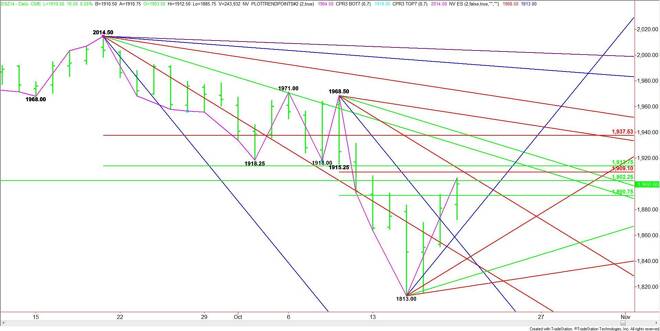

E-mini S&P 500 Index (ES) Futures Technical Analysis – October 21, 2014, Forecast

By:

December E-mini S&P 500 Index futures surged ahead on Monday, taking out a short-term 50% level, only to put it in a position to test a series of

December E-mini S&P 500 Index futures surged ahead on Monday, taking out a short-term 50% level, only to put it in a position to test a series of other retracement levels. Although Monday’s move helped make 1813.00 a new main bottom, the main trend is still down and sellers are likely to try to defend the trend, making a rally today a grind.

The first target today is a 50% level at 1902.25, followed closely by a steep downtrending angle at 1904.50. A Fibonacci level at 1909.00 and a 50% level come in at 1913.75. With possible resistance levels layered between 1902.25 and 1913.75, look for a lot of stop-and-go trading today. The daily chart doesn’t indicate a breakout could take place until 1913.75.

The daily chart opens up over 1913.75 with 1926.50 the next target, followed by 1936.50 and a Fibonacci level at 1937.50.

The first sign of weakness today will be the failure to overcome 1902.25, but don’t expect an acceleration to the downside unless 1890.75 fails under heavy volume. The next likely target is a steep uptrending angle at 1877.00.

The tone of the market today should be determined by trader reaction to 1902.25.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement