Advertisement

Advertisement

Fewer But Meaningful Releases To Keep Forex Players Busy

By:

Last week’s busy economic calendar provided wild moves into the Forex market. The USD liquidated some of the early week gains that were piled up by the

Last week’s busy economic calendar provided wild moves into the Forex market. The USD liquidated some of the early week gains that were piled up by the Factory Order numbers as lesser than expected NFP provided immediate harm to the USD; however, the upwardly revised June NFP numbers, together with improvements in hours worked, restricted the losses, resulting the first in three weeks positive closing by the US Dollar Index (I.USDX). The BoE disappointed the GBP bulls as only one policy maker favored the interest rate change, against the two forecasted, while the central bank, in its Quarterly Inflation Report (QIR), tamed down chances of near-term interest rate hike with a revised down inflation outlook. Further, commodity currencies, namely AUD, NZD and CAD, witnessed mixed moves as declining Crude prices and not so good labor market numbers weakened the NZD and CAD while better job numbers, coupled with the change in RBA monetary policy statement, negating the favor for additional AUD weakness, helped the Australian Dollar register considerable gains. Moreover, the JPY resulted into a bit of weakness with Bank of Japan favoring lose monetary policy with downward revision to growth and inflation marks.

Having witnessed noticeable forex moves, the second week of August offers lesser economic details to the market players. However, EU GDP, UK job numbers and the US Retail Sales are likely statistics that could provide meaningful information to help determine near-term market direction. Let’s briefly discuss them.

Consumer-Centric US Details To Help Foresee USD Moves

With the advanced numbers of Q2 2015 US GDP, coupled with better Durable Goods Orders and Factory Orders, favoring a strong economic growth during the second quarter, consumer-centric details, namely Retail Sales and Preliminary UoM Consumer Sentiment, could become helpful to better analyze the chances of strong economic rebound after witnessing growth contraction of -0.2% in Q1 2015.

Monthly reading of Retail Sales and Preliminary UoM Consumer Sentiment, scheduled for Thursday and Friday, favors an upward transition of the US Dollar as both the numbers are likely surpassing their previous marks. The July month Retail Sales is expected to reverse its June contraction of -0.3% with 0.5% mark while the consumer sentiment index bears the forecast of printing 93.5 number against the previously revised down reading of 93.1. Optimism surrounding strong economic growth is likely to be maintained with better consumer-centric numbers, favoring near-term interest rate hike speculation and the USD up-move; however, weaker readings could dilute growth numbers and force the Fed to delay their first interest lift-off since 2006, that in-turn could damage the recent greenback strength.

Other than these crucial details, the quarterly releases of Preliminary Nonfarm Productivity and Unit Labor Costs, scheduled for Tuesday, and the monthly Capacity Utilization Rate & Industrial Production, to be released on Friday, are some of the second-tier economic readings that could help determine near-term USD moves. While the Non-farm productivity has been increased by 1.6% against previous contraction of -3.1%, the unit labor cost is likely revealing first negative number of -0.1% since February 2014. Moreover, the Capacity Utilization is likely been to 78.00% compared to its previous 78.40% and the industrial production growth seems static near 0.3%. Hence, majority of the economic details favor robust US economic numbers during Q2 2015, supporting the intact speculations concerning September rate hike and the USD upward trajectory.

UK Job Numbers May Clarify GBP Trend

Even if the Bank of England, in its QIR, disappointed GBP bulls, strong growth numbers, revealed in preliminary Q2 2015 GDP, still favors the GBP up-move; however, market players would closely examine the monthly labor market details, scheduled for Wednesday, in order to get updated from the UK economic transition and the near-term moves of the Great Britain Pound.

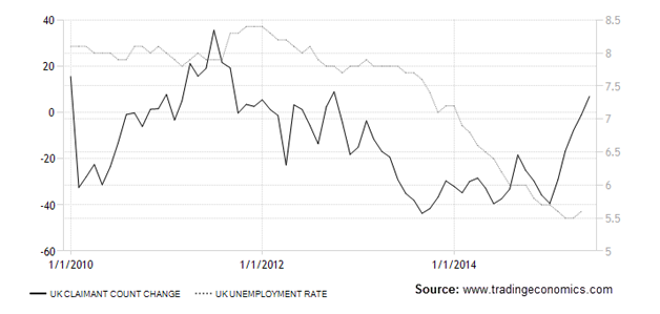

While the UK Unemployment Rate stands near the seven years low, the recent uptick in Claimant Count Change could restrict the central bank from increasing their benchmark interest rates. The Unemployment Rate is expected to remain static near 5.6% while the claimant count change is likely advanced lesser by 1.4K against the previous rise of 7.0K, Moreover, the Average Earnings may have retreated from a 3.2% gain during June to 2.8% rise in July. Hence, weaker claimant count change may help nullify the damages done via lesser average earnings, favoring near-term GBP up-move; however, a spike in unemployment rate, which is less expected, could restrict the immediate advance by the GBP.

European Growth Numbers Could Trigger EUR Bounce

Off-late the European economic details have been mixed and failed to clarify the region’s strength; however, German & EU ZEW Economic Sentiment, to be released on Tuesday, and the Flash reading of Q2 2015 GDP growth numbers, scheduled for Friday, may help generate meaningful information to base Euro trades.

ZEW indices for Germany and Euro-zone favor the EUR up-move as the German reading is likely printing 31.1 mark against 29.7 prior while the forecast relating to Euro-zone index favors 43.9 number compared to its previous reading of 42.7. Moreover, the Flash reading of EU GDP Q2 2015 GDP indicates that the region may have grown uniformly with 0.4% number marked during Q1 2015, the highest percentage since May 2011.

Other than the quantitative details, progressive talks between the Greece and its international creditors signal that the troubled nation will soon be able to secure another tranche of much required bailout package, favoring the EU optimism and immediate Euro up-move.

With the Greece near to agreement on bailout package with its international creditors, strong growth numbers from the European economy could stave-off the near-term EUR bears, providing a quick bounce to the regional currency.

Releases From The Rest Of Globe

Apart from headline numbers from EU, US and UK, recent BoJ Meeting Minutes, Australian NAB Business Confidence, Westpac Consumer Sentiment and Wage Price Index q/q, coupled with Chinese Industrial Production y/y are some other details that could help fueling the Forex volatility during the current week.

After the Bank of Japan (BoJ), in its recent monetary policy meeting, favored the currently loose monetary policy and cited the risk of further decline in growth and inflation outlook should the crude prices weaken further, market players are likely to analyze the minutes in detail to look for hints relating to weakness in Japanese economy. Should the BOJ minutes, scheduled for Wednesday release, reveal that the export oriented nation is struggling and there are more chances of additional monetary easing, the JPY could become vulnerable to extend its decline.

The Chinese pessimism have been worsening day by day and a weaker than expected reading of monthly Industrial Production, scheduled for Wednesday, cold provide additional damages to the commodity currencies and industrial world. The consensus favors a weaker industrial production growth of 6.7% against its previous reading of 6.8%. Hence, a number lesser than the 6.7% could become detrimental for commodity currencies, namely AUD, NZD and CAD.

Other than the Chinese Industrial Production, Tuesday’s Australian NAB Business Confidence and the Westpac Consumer Sentiment and Wage Price Index q/q, scheduled for Wednesday, could become helpful to foresee near-term AUD moves. With the recent improvement in NAB Business Confidence, better than expected Consumer Sentiment reading and rising Wage Prices could help the AUD maintain its recent surge. However, weaker Chinese details and disappointing numbers are likely trimming the recent gains by the Aussie.

Follow me on twitter to discuss latest markets events @Fx_Anil

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement