Advertisement

Advertisement

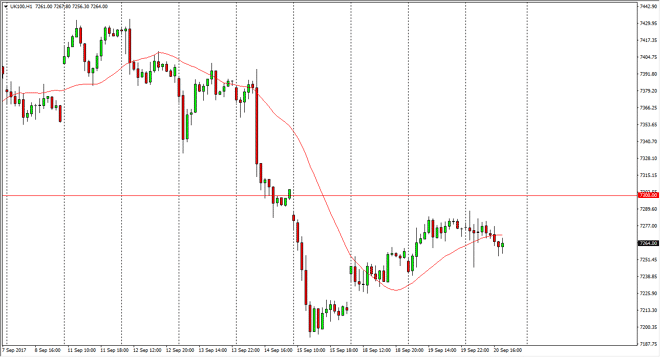

FTSE 100 Index Price Forecast September 21, 2017, Technical Analysis

Updated: Sep 21, 2017, 06:06 GMT+00:00

The FTSE 100 drifted a little bit lower at the open on Wednesday, as the 7300 level looks to be causing a bit of resistance. I think that the market

The FTSE 100 drifted a little bit lower at the open on Wednesday, as the 7300 level looks to be causing a bit of resistance. I think that the market pulling back from here makes a lot of sense, as there is a gap below to be filled. Eventually, I anticipate that this market will break above the 7300 level, perhaps driving towards the 7400 level. The alternate scenario of course is a breakdown below the 7200 level, which would be very negative. Currently, I believe that the British pound rallied against the US dollar is putting quite a bit of pressure on the FTSE 100, and that could continue. I believe the traders will continue to favor the European Union over the United Kingdom, especially with interest rates looking likely to rise in the UK due to surprise inflationary numbers.

Caution needed

This has been an extraordinarily bullish market for some time, and caution may be needed. Ultimately, this is a market that is going to be highly correlated in a negative fashion to the GBP/USD pair, which looks like it could break out to the upside for a huge move. If it does, that could be very negative for British exports overall, and of course way upon the FTSE 100 as it is full of export driven companies. Alternately though, if we break above the 7300 level, we are clearing a gap, and then at that point it doesn’t matter what’s happening in the currency market, you simply just trade with the chart tells you. I think we are going to see a significant amount of volatility, and therefore you need to be careful. Trading a small position might be the best way to go, as this choppiness could cause a lot of psychological discomfort.

FTSE 100 Video 21.9.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement