Advertisement

Advertisement

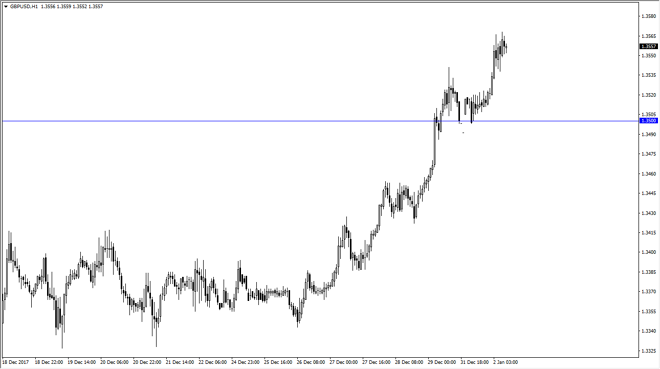

GBP/USD Price Forecast January 3, 2018, Technical Analysis

Updated: Jan 3, 2018, 07:09 GMT+00:00

The British pound rallied significantly during the trading session on Tuesday, as the British pound has seen a significant amount of buying pressure. We have broken above the 1.35 handle recently, and we have pulled back a little bit from the highs, but I believe that the 1.3650 level above is probably a massive barrier.

The British pound continues to be very volatile, but obviously buyers have come back significantly. I think that the market should go looking towards the 1.3650 level above, which is a major area to pay attention to on the chart. That was an area where we gapped lower significantly after the surprise vote to leave the European Union. Ultimately, I believe that the market breaking above that level is a longer-term “buy-and-hold” scenario, and then we would probably at every time the market dips. I believe that ultimately this is a market that should continue to be difficult, but given enough time I think that we will probably start the 1.40 level. Between now and then, the 1.35 level should offer a bit of a short-term floor, but a breakdown below there would necessarily be impossible either.

I believe that the US dollar is going to continue to soften in general, and I believe that the British pound will continue to benefit from that reason alone. But longer-term, it looks as if the British pound has been offering value the people are willing to take advantage of, and I think that the longer-term attitude of this market is trying to change. Eventually, I suspect that this will become one of the value plays of 2018. Expect a lot of noise between now and the nonfarm payroll numbers though, so be careful and to keep your position size small.

GBP/USD Video 03.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement