Advertisement

Advertisement

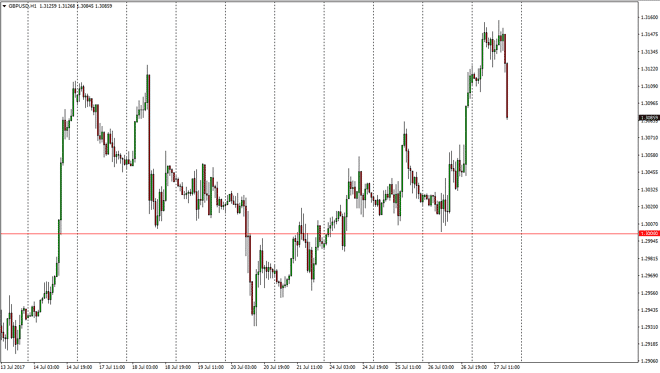

GBP/USD Forecast July 28, 2017, Technical Analysis

Updated: Jul 28, 2017, 04:56 GMT+00:00

The British pound initially rally during the day on Thursday, continuing the bullish pressure that we had seen on Wednesday. We went sideways for a while,

The British pound initially rally during the day on Thursday, continuing the bullish pressure that we had seen on Wednesday. We went sideways for a while, but as the Americans came online, this pair rolled over again, perhaps a little bit of profit-taking being the culprit. However, I think that this market selling office strongly as it has suggested that perhaps we are going to see some type of issue. I believe that eventually we will find a buy signal, but we don’t have one quite yet. The 1.30 level underneath should be massively supportive, and I use that is a signal as to whether the uptrend can continue.

Buying dips, but not yet

I’ve been buying dips, but I’m not ready to do it again. I believe that this massive selloff is a bit disconcerting, and that means that we could see continued bearishness. If we were to finally break down below the 1.2950 level, then I would start selling rapidly. Until then, I believe that it’s a matter of time before the buyers return, but I do not see in impulsive or supportive candle that tells me it’s time to get involved again. Ultimately, I believe that the 1.30 level is what the market is using as a barometer of direction in this market. This market will be very choppy and has the wildcard of the European Union negotiations involved in it as well, as there will be headlines crossing the wire from time to time that could move the British pound in general. Because of this, I think that the market, although volatile, will eventually find its footing as the Federal Reserve looks likely to stay loose as far as monetary policy is concerned, although this pair may lag some of the other pairs against the US dollar.

GBP/USD Video 28.7.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement