Advertisement

Advertisement

Gold Price Prediction for February 21, 2018

By:

Gold prices moved lower on Tuesday as the dollar rebounded against most major currencies. A softer than expected German ZEW survey was the catalyst that

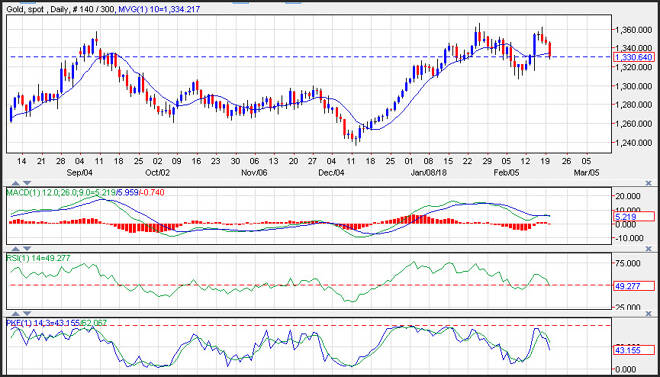

Gold prices moved lower on Tuesday as the dollar rebounded against most major currencies. A softer than expected German ZEW survey was the catalyst that weighed on the EUR/USD. Prices of the yellow metal dipped through support near the 10-day moving average at 1,334, and is poised to test the February lows at 1,307. Resistance is now seen near former support at the 10-day moving average.

Momentum has turned negative as the MACD (moving average convergence divergence) index generated a crossover sell signal. This occurs as the MACD line (the 12-day moving average minus the 26-day moving average) crosses below the MACD signal line (the 9-day moving average of the MACD line). The MACD histogram is printing in the red with a downward sloping trajectory which points to lower prices. The fast stochastic also generated a crossover sell signal and is moving lower which reflects accelerating negative momentum. This was confirmed by the decline in the RSI (relative strength index) which moved lower in tandem with price action which also reflects negative momentum.

The German ZEW survey slipped

The measure of the current situation eased to 92.3 from 95.2 and the expectations component fell to 17.8 from 20.4. On one hand, the German economy continues to motor along but political uncertainty lingers.

U.S. NAHB housing market index was unchanged

U.S. NAHB housing market index was unchanged at 72 in February after falling 2 points to 72 in January from December’s 74). It was 65 a year ago. The current single family sales index dipped to 78 from 79. The future sales index rose to 80 from 78, and is the highest since June 2005. The index of prospective buyer traffic was flat at 54. The report indicated builders are excited about the pro-business political climate, but noted ongoing supply side hurdles, including labor shortages and building material price increases.

About the Author

David Beckerauthor

David Becker focuses his attention on various consulting and portfolio management activities at Fortuity LLC, where he currently provides oversight for a multimillion-dollar portfolio consisting of commodities, debt, equities, real estate, and more.

Advertisement