Advertisement

Advertisement

Important CAD Pairs’ Technical Overview: 31.05.2017

By:

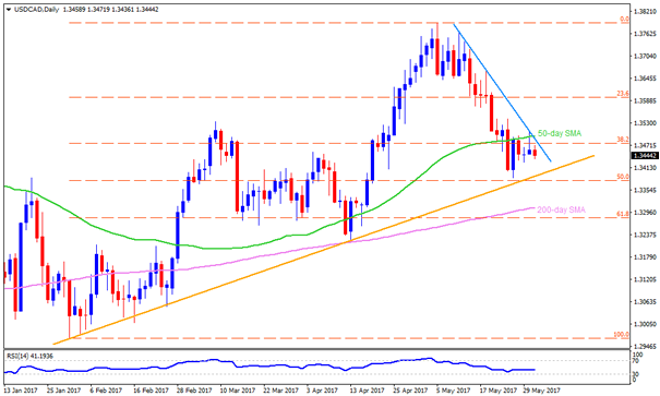

USD/CAD With the three-week old descending trend-line, coupled with 50-day SMA, restricting the USDCAD’s near-term advances around 1.3495 – 1.3500, the

USD/CAD

With the three-week old descending trend-line, coupled with 50-day SMA, restricting the USDCAD’s near-term advances around 1.3495 – 1.3500, the pair becomes more likely to re-test four-month long upward slanting TL, near 1.3390, if Canadian GDP matches 0.3% forecast. Given the pair drops below 1.3390 on a daily closing basis, the 1.3350 and the 1.3330 may offer intermediate halts during its plunge towards 200-day SMA level of 1.3310. On the contrary, disappointing growth-figure and weak Crude prices might propel the pair to surpass 1.3500, which in-turn could open the door for 1.3570, the 1.3600 and the 1.3640 consecutive resistances to appear on the chart. Moreover, Bulls dominance after 1.3640 can help the buyers to aim for 1.3730 and the 1.3800 round-figure.

EUR/CAD

Even after taking a U-turn from a week-long descending trend-line resistance, the EURCAD may bounce-off from 1.5015-10 horizontal-line and can again challenge the 1.5085 TL on weaker Canadian details. Should the pair clears 1.5085 mark, it becomes capable enough to claim 1.5130 and the 1.5160 resistances while its following advances may have to conquer 1.5200 round-figure in order to meet 1.5250 & 1.5280 numbers to north. In case if the 1.5015-10 support-zone fail to play its role, the 1.4980 and the 1.4965 can entertain short-term sellers prior to pleasing them with 61.8% FE level of 1.4950. During the pair’s additional downturn below 1.4950, chances of witnessing 1.4900 and the 1.4860 can’t be denied.

CAD/JPY

CADJPY’s defeat from 82.60 seems presently dragging it to 82.15-20 horizontal-line, breaking which the pair can meet 82.00 and then to 81.75 support-levels. Given the sustained trading below 81.75, the 81.30 and the 81.00 are likely buffers that can further direct the moves to month-low around 80.60. Meanwhile, a clear break of 82.60 enables the pair to flash 82.85 and the 83.00 resistances, clearing which 83.50 seems crucial to observe, which if broken could escalate the north-run towards 61.8% FE level near to 84.00.

AUD/CAD

While a fortnight old descending trend-line seems aptly restricting AUDCAD’s up-moves, the pair is expected to meet a bit longer downward slanting TL, around 0.9995. If the pair refrains from respecting 0.9995, the 0.9950, the 61.8% FE level of 0.9970 and the April low around 0.9920 could be availed as rest-points. Alternatively, break of the 1.0050 TL confirms short-term bullish formation and can propel the quote to 1.0080 and then to 1.0120. In the course of pair’s northwards trajectory beyond 1.0120, the 1.0160 and the 1.0200 are the resistances that could gain attention.

Cheers and Safe Trading,

Anil Panchal

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement