Advertisement

Advertisement

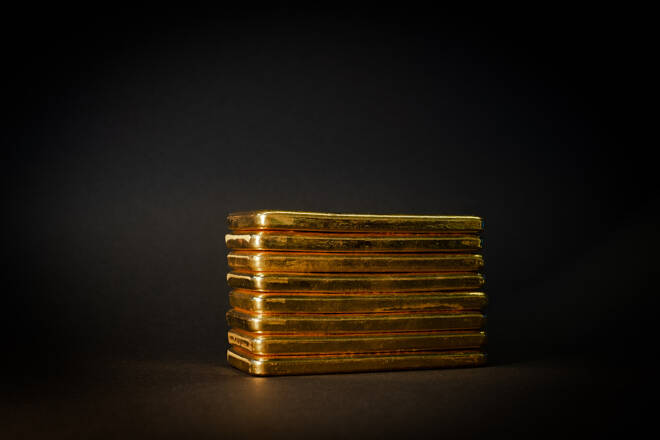

Long-term Bullish Market Sentiment Still Fully Intact

By:

The CPI and PPI reports continue to strongly support gold prices, given the methodical decline in inflation.

Soft Inflation Report Spurs Fed Pause on Rate Hikes

Yesterday’s significant drop in the dollar was directly related to the release of the October CPI inflation report, revealing muted growth, similar to September’s low reading. Despite forecasts by major analysts and economists predicting higher levels, the actual inflation remained below expectations. This outcome strengthens the case for the data-dependent Federal Reserve to extend its pause on rate hikes and potentially end the rate hike cycle earlier than anticipated in the September dot plot.

The CME Fedwatch tool, a widely used probability indicator, now places a 100% certainty that the Federal Reserve will not raise rates at the December FOMC meeting, up from 90.4% a week ago and 69.6% a month ago.

Inflation has continued its decline from 9.1% in June 2022 to the current 3.2% year-over-year level. This steady reduction is seen as evidence that inflation is on track to reach its 2% target, likely contributing to the Federal Reserve’s decision to halt the historic 11 consecutive rate hikes.

Gold vs US Dollar Correlation

Yesterday’s double-digit gain of $16.80 in gold prompted warranted consolidation, driven not by market participants initiating long positions but by extreme dollar weakness, resulting in a 1.51% decline. Today, the opposite occurred with dollar strength erasing fractional gains in gold. Physical (spot) gold is currently at $1959.70, down three dollars, reflecting the impact of a moderately higher dollar, according to the Kitco gold index.

Gold futures for February 2024, as of 5 PM EST, are fixed at $1983.30, down $3.80 or 0.19%. Dollar strength, accounting for about two-thirds of gold’s decline today, and contrasts with extremely fractional gains from market participants buying gold.

Inflation Impact on Gold and Fed’s Policy Outlook

Today’s modest gold decline is inconsequential in the broader context, affirming the diminishing impact of inflation on the Federal Reserve’s monetary policy. Analysts, including myself, anticipate that the consistent drop in inflation will prompt the Federal Reserve to conclude rate hikes. Furthermore, it’s likely to expedite the timeline for the first rate cut, with predictions ranging from March 2024 to May of next year.

The CPI and PPI reports continue to strongly support gold prices, given the methodical decline in inflation. This trend, coupled with the lag between a rate cut and its economic effects, suggests that the Fed may not require additional quantitative tightening, opening the possibility for a pivot towards cutting interest rates rather than increasing them.

For those who would like more information simply use this link.

Wishing you as always good trading,

Gary S. Wagner

About the Author

Gary S.Wagnercontributor

Gary S. Wagner has been a technical market analyst for 35 years. A frequent contributor to STOCKS & COMMODITIES Magazine, he has also written for Futures Magazine as well as Barron’s. He is the executive producer of "The Gold Forecast," a daily video newsletter. He writes a daily column “Hawaii 6.0” for Kitco News

Advertisement