Advertisement

Advertisement

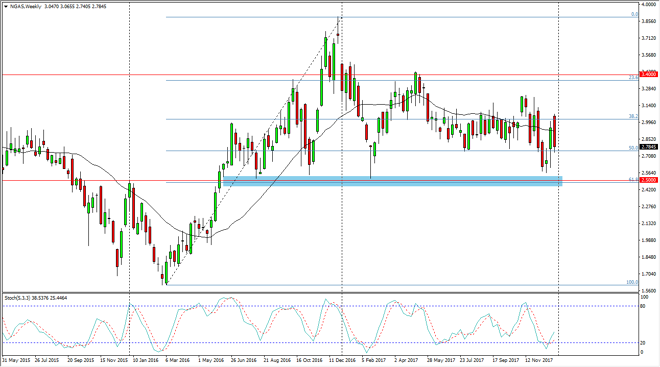

Natural Gas Price forecast for the week of January 8, 2018, Technical Analysis

Updated: Jan 6, 2018, 05:56 GMT+00:00

Natural gas markets continue to be very choppy and volatile, but this past week was extraordinarily negative. Because of this, I think that the market is going to continue to offer selling opportunities going forward. However, I see a hard floor below.

Natural gas markets continue to be a very choppy affair, and this is how only increasing at this point. I think that the weekly candle was very interesting, considering that we gapped higher, and then just started falling right away. The $3 level has offered more than enough resistance, but I also recognize that there is massive support just below. It is going to be very difficult to hang onto a longer-term position in this market, although I certainly think that the negativity in the market tells you which direction you should be looking. I think that short-term rallies offer selling opportunities, and that’s probably the best way to trade this market. This is because although we are very negative, the problem is that the markets are at historically low levels. I believe we are currently bouncing around between the $2.50 level on the bottom, and somewhere around the $3.33 level on the top. A bounce could happen on the weekly chart, but at that point I would be looking for selling opportunities. To sell from here, you would have to do so from a short-term perspective, although it certainly could profit.

In general, I don’t like the natural gas prospects going forward, as we have such a massive oversupply of the natural gas stock, and I think that the easy ability of Americans to flood the market with supply will continue to be a massive problem for buyers. At this point, it looks very much like gold markets in the 1980s: sell every time you can.

NATGAS Video 08.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement