Advertisement

Advertisement

PMIs, Job Details And Central Bankers To Dominate The Market Moves

By:

Even if better than expected reading of the US Durable Goods Orders and hawkish tone of the Federal Reserve fueled chances concerning sooner lift-off to

Even if better than expected reading of the US Durable Goods Orders and hawkish tone of the Federal Reserve fueled chances concerning sooner lift-off to the Fed rate, record low reading of quarterly Employment Cost Index (ECI), coupled with weaker Consumer Confidence Index and Advance GDP, caused the US Dollar Index (I.USDX) to close the week in marginally negative territory. The Euro region currency kept struggling against majority of its counterparts with mixed economic readings while the GBP registered considerable gains as preliminary reading of Q2 2015 GDP favored BoE’s remarks of strong economic recovery, signaling near-term interest rate hike. Commodity currencies, namely AUD, CAD and NZD, extended their declines as weaker commodity prices, mainly fueled by pessimism over China, coupled with not-so-good fundamental numbers, kept hurting their outlook.

Going forward, lots of important events/announcements are likely to make market players busy during the first week of the August. Amongst them, monthly details of headline PMI numbers from UK, US and China, monetary policy meetings by the BoJ, RBA and the BoE, together with BoE Inflation report, and the labor market details from US, Australia and the New-Zealand, are key releases to dominate the forex market. Let’s discuss them in detail.

US NFP Is Amongst The Crucial Labor Market Announcements

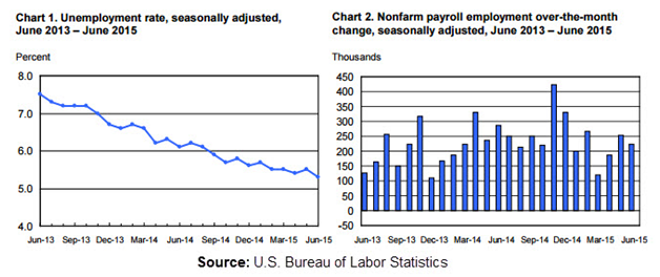

Although, labor market details from Australia and New-Zealand are also scheduled for release during the current week, US job numbers, namely the Non-farm Payrolls (NFP) and the Unemployment Rate, scheduled for Friday release, are likely to gain considerable market attention. With recent comments from the Fed signaling the need of “some” improvement in labor market details to introduce first interest rate hike since 2006, the actual readings will help forecast whether the central bank will go for interest rate lift-off in September, or during current year or not.

In its latest release, the NFP maintained its +200K mark while the Unemployment Rate plunged to the lowest since August 2008. The figures aren’t expected to print considerable moves as the NFP bears consensus of 224K and the Unemployment is likely remaining unchanged at 5.3%. With the change in Fed’s tone for the improvement in labor market details, sustainably positive NFP above 200K and a near 5.00% Unemployment Rate could continue favoring chances of the Fed’s September interest rate hike, fueling the USD rally; however, a surprise plunge in NFP below 200K and/or higher unemployment rate, which seems less likely to happen, can provide considerable damages to the greenback’s upward trajectory. Moreover, monthly reading of ADP Non-Farm Employment Change, scheduled for Wednesday, becomes an intermediate labor market reading to help forecast the Friday’s numbers. The number is likely declining a bit to 218K against its previous 237K and can provide near-term correction in USD strength should the actual figures match forecasts.

Other than the headline numbers, ISM Manufacturing and Non-manufacturing PMIs, scheduled for release on Monday and Wednesday, coupled with Wednesday’s Trade Balance details, are likely additional numbers that could help determine near-term USD moves. While the Manufacturing PMI is less likely to register considerable improvement with a forecast to print 53.6 from 53.5, the Non-Manufacturing PMI is expected to test 56.4 mark against 56.00 and the Trade Deficit may have widened to -42.6B against -41.9B. Hence, improvement in PMIs could surpass negative effects of weaker Trade Balance, helping the USD maintaining its up-move.

BOE Inflation Report and PMIs To Determine GBP Moves

Recent comments from Bank of England (BoE) Governor that the central bank is closer to the interest rate hike, coupled with the improvement in Q2 2015 Preliminary GDP numbers, forces market players to focus on Quarterly Inflation Report (QIR), scheduled for release on Thursday, to look for the hints relating to the interest rate hike, that could possibly fuel considerable GBP strength. In Its May release, the BoE cut down 2015 growth forecast from 2.9% to 2.5%, together with weaker outlook for Inflation, and said that the central bank is less likely to increase their bench mark interest rate before Q2 2016; However, it did signal noticeable improvement in labor market details. Hence, an upward revision to the growth and inflation numbers and/or hawkish comments by the Governor, during his speech after the report release, strongly supports the speculations concerning near-term interest rate hike by the BoE, in-turn fueling the GBP rally.

Having witnessed better than expected UK Manufacturing PMI, to 51.9 against 51.4 prior, during its Monday release, Construction and Services PMIs, scheduled for Tuesday and Wednesday respectively, are likely to provide intermediate moves to the market prior to monthly details of Manufacturing Production and Trade Balance, scheduled to release on Thursday and Friday respectively. While the Construction PMI is expected to test five month high, to 58.6 from 58.1, the Services PMI, core to the UK GDP, signals a mild weakness in reading of 58.1 from previous 58.5. Moreover, consensus relating to the Manufacturing Production signals reversal of two month old contraction by 0.2% advance and the UK Trade deficit is likely widened to -9.1B as compared to its previous release of -8.0B. With headline numbers signaling mixed traits of UK economy, it becomes important to observe the actual details in order to better determine the GBP moves.

Bank of Japan (BoJ) Monetary Policy Meeting

BoJ Governor, in his talks with Yomiuri newspaper on Saturday, said that there’s no immediate need for additional monetary easing and the economy is steadily improving towards targeted goals; however, market players don’t believe him and keep expecting continuous flow of extra large monetary easing from the central bank. Though, the BoJ, in its monetary policy meeting on Friday, isn’t expected to announce any changes in its current monetary policy, comments by the Governor, following the rate announcement, are likely to be observed closely to foresee near-term JPY moves. Should the central banker retreats from his favor to lose monetary policy, the JPY should witness considerable up-moves while a passive talks of the need to current policy measures could help JPY stretch its recent decline.

Details Affecting Antipodean Currencies

Alike majors, antipodean currencies, namely AUD, NZD and CAD, are also likely to witness considerable moves backed by strong fundamental details/events that starts with monetary policy meeting by the Reserve Bank of Australia (RBA) on Tuesday. Even if the central bank isn’t expected to alter their current monetary policy, either a surprise rate cut or dovish lines in Rate Statement could provide considerable damages to the AUD. Moreover, the Australian Retail Sales m/m and Trade Balance, also scheduled for Tuesday release, coupled with Thursday’s labor market details, could also provide considerable AUD moves. While the Retail Sales is expected to rally to four month high of 0.5%, the Trade deficit is likely widening to -3.06B against -2.75B prior. The labor market numbers, namely Employment Change and Unemployment Rate, signal mixed results as Employment Change is likely expanded to 12.5K against 7.3K prior while the Unemployment Rate bears the three month high consensus to 6.1% against 6.0% previous reading. At the Chinese front, Australia’s largest consumer, Caixin Services PMI and the Trade Balance, scheduled for Wednesday and Saturday respectively, could also gain the market attention after the recent plunge in Caixin Final Manufacturing PMI to the two years low. The Services PMI is likely register an advance to 52.2 from 51.8 prior while the Trade surplus is likely rallied to 53.4b against 46.5B. Weaker details from China, coupled with absence of strong domestic numbers could continue favoring AUD downward trajectory.

New-Zealand Employment Change and Unemployment Rate, scheduled for Tuesday, coupled with the Canadian Trade Balance, scheduled for Wednesday, are the details that could help determine the respective moves of NZD and CAD. With the higher that previous unemployment rate, to 5.9% from 5.8%, and a slower growth in employment change, to 0.5% from 0.7%, recent comments from the RBNZ, that further cuts in interest rates are likely, becomes more important. Should the labor market numbers, coupled with trade details, continue favoring the need for extra loose monetary policy, RBNZ becomes even more likely to keep going in its rate cut path, providing considerable NZD decline. From the Canadian economy, monthly release of Trade Balance and Ivey PMI, scheduled for Wednesday and Friday respectively, signals mixed results as the Trade deficit is expected to shrank to -2.8B against previous -3.3B while the PMI consensus favor a print of 56.2 against prior 55.9. With the stall in trade numbers, CAD can witness a mild pullback in its on-going decline; however, weakness in Crude prices, its main export, could continue favoring the broader downturn of the Loonie, as it is nicknamed.

Follow me on twitter to discuss latest markets events @Fx_Anil

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement