Advertisement

Advertisement

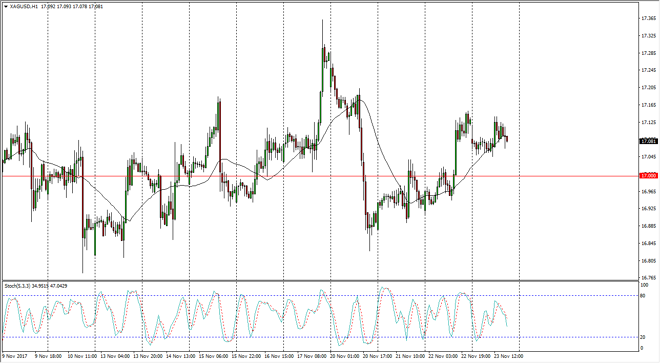

Silver Price Forecast November 24, 2017, Technical Analysis

Updated: Nov 24, 2017, 05:05 GMT+00:00

Silver markets when sideways during the trading session on Thursday, after initially gapping lower. We are just above the $17.05 level, so it looks very

Silver markets when sideways during the trading session on Thursday, after initially gapping lower. We are just above the $17.05 level, so it looks very likely that we will continue to see a lot of choppiness. After all, we have been consolidating between the $17.20 level above, and the $16.80 level underneath. This is a choppy market, and therefore I think that we will continue to trade in a back and forth type of situation. I think that using a range bound strategy to trade silver is probably the best way to go. I’m currently using the Stochastic Oscillator, as my secondary indicator to trade the market. Ultimately, on crossovers in either overbought or oversold conditions, I am looking for the market to go back to the $17 level, something that has worked quite well lately.

If we were to break above the $17.25 level, the market should continue to go much higher, perhaps towards the $17.50 level. Alternately, if we were to break down below the $16.80 level, the market should drop down to the $16.50 level after that. Currently though, unless we get some type of external pressure, perhaps with a collapsing US dollar or some type of geopolitical issue, I think that Silver stays in the range that it’s been in, and therefore that’s how you must trade this market. While I typically don’t like jumping straight into the futures market, I believe that trading this type of tight range sometimes can be very beneficial in the futures market, as the amount of money to be made is much stronger. Alternately, if you do not have the ability to trade the futures market, CFD markets continue to be the best way going forward. Options markets are starting to offer way too little in the way of premium to be bothered with.

SILVER Video 24.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement