Advertisement

Advertisement

Silver Price Forecast November 29, 2017, Technical Analysis

Updated: Nov 29, 2017, 09:41 GMT+00:00

The Silver markets went back and forth during the trading session on Tuesday, dancing around the $17 level. I think that the market breaking below that

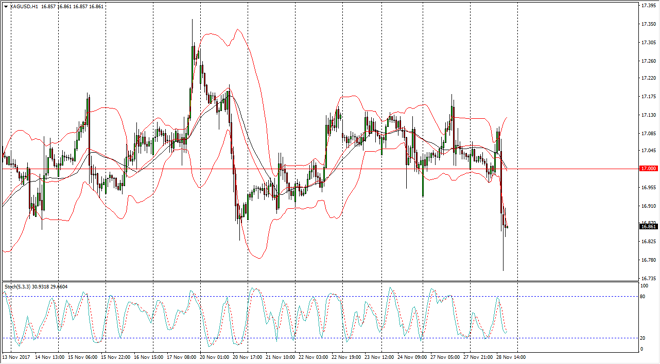

The Silver markets went back and forth during the trading session on Tuesday, dancing around the $17 level. I think that the market breaking below that level late in the day is a very negative sign though, and of course we are starting to crossover at a low level on the Stochastic Oscillator, showing that we may be in an oversold position. Also, momentum is turning right back around, and it’s likely that reaching the bottom of the Bollinger Bands shows that the buyers could return as well. Beyond that, the $16.80 level has been supportive in the past, as we continue to go back and forth. It is these reasons that I am willing to step in and start buying silver on a move above the $16.90 level, and take profits just above the $17 level. I continue to trade this market back and forth, using sizable leverage to make the profits worthwhile. If we were to break down below the $16.75 level, the market could go down to the $16.50 level after that.

Alternately, once we break out to the upside, it’s not until we clear the $17.25 level that I would be concerned about trading the range. Until then, the market continues to go back and forth, and therefore that’s why I use leverage. It’s difficult to imagine that the market will be easy to deal with, as there are a lot of concerns when it comes to the US dollar, especially due to the US Congress not being able to pass significant tax reform. That continues to cause a lot of issues in the greenback, and by extension the opposite move in the silver market as precious metals continue to be highly sensitive and influenced by what happens in the US dollar.

SILVER Video 29.11.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement