Advertisement

Advertisement

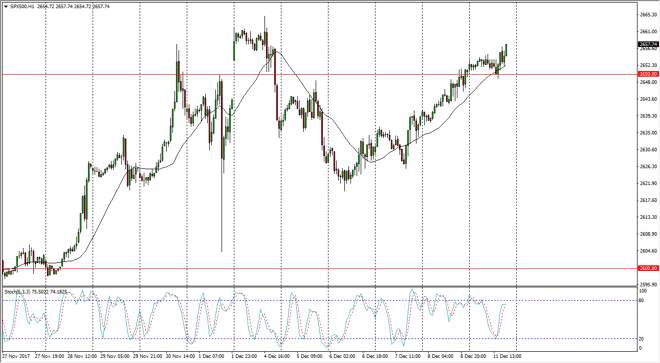

S&P 500 Price Forecast December 12, 2017, Technical Analysis

Updated: Dec 12, 2017, 06:07 GMT+00:00

S&P 500 traders initially were quite during the trading session on Monday, but found the 2650 level interesting enough to go long.

The S&P 500 initially drifted sideways during the trading session on Monday, pulling back to the 2650 handle underneath. That’s an area that has been important more than once, and the fact that we found buyers there is not a huge surprise. I think that we now are ready to go towards the highs again near the 2665 level above. Longer-term, I believe that we go to the 2700 level and beyond. After all, the 2700 level is a large, round, psychologically significant number. Ultimately, I think that if we were to break down below the 2650 handle, then we could go lower, perhaps reaching down to the 2600 level. The volatility in this market should continue to be an issue, but overall this time of year we tend to see the “Santa Claus rally”, which is essentially when fund managers tried to pad their accounts with the wedding trades, to make up for a lack of production during the year.

I think that short-term pullbacks continue to offer value that these people are willing to take advantage of, as they do almost every year. The tax bill conversation of course continues to dominate the headlines, and if he gets past that could help the S&P 500 as well. It’s not until we break down below the 2600 level that I would be interested in shorting this market, something that I don’t see happening anytime soon. If we break above the 2700 level, that should send this market much higher as we would continue the longer-term trend to the upside. I believe in general, the market continues to be one that buyers jump to.

S&P 500 Video 12.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement