Advertisement

Advertisement

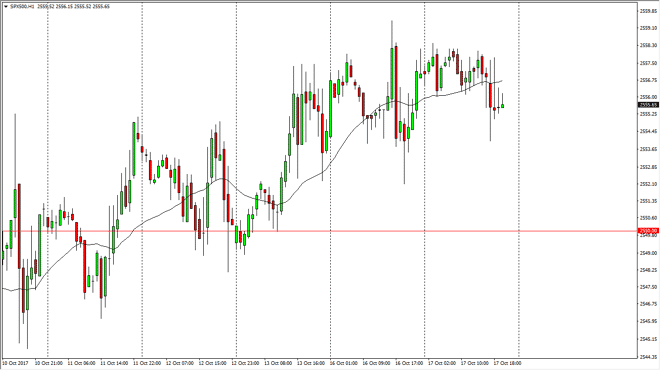

S&P 500 Price Forecast October 18, 2017, Technical Analysis

Updated: Oct 18, 2017, 07:38 GMT+00:00

The S&P 500 went sideways during most of the session on Tuesday but then drifted a bit lower. Quite frankly, the market looks a bit stagnant and is

The S&P 500 went sideways during most of the session on Tuesday but then drifted a bit lower. Quite frankly, the market looks a bit stagnant and is probably going to continue sideways in general, as we have seen a significant amount of gains as of late, and may need to digest this move. Because of that, I think that it’s only a matter of time before we rally, but it could be a bit choppy between now and then. Markets will more than likely find a reason to go higher through earnings, as we have already seen financials do very well. That, of course, is a major component of the S&P 500, and that should continue to help drive this market higher longer term. However, a lot of traders will be cognizant of the fact that we have gone very far in a very short amount of time, so it’s difficult to imagine a scenario where we just take off immediately. I think that some of the digestion that we are seeing right now is very healthy for the market, and dips should continue to be thought of as buying opportunities. I believe that the 2550 handle is going to be a bit of a “floor” in the market, but short-term dips below there could happen as well. I think there’s even more supportive the 2540 level.

I think that some of the digestion that we are seeing right now is very healthy for the market, and dips should continue to be thought of as buying opportunities. I believe that the 2550 handle is going to be a bit of a “floor” in the market, but short-term dips below there could happen as well. I think there’s even more supportive the 2540 level.

S&P 500 Video 18.10.17

Longer-term, I still have a target of 2600, and even higher than that. To take a while to get there, and we may need to get through earnings season before we are comfortable rallying as such, but I certainly think that’s the way of things to go. Every time this market pulls back you should be thinking about the value being offered, as it’s essentially the S&P 500 “on sale.”

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement