Advertisement

Advertisement

Technical Outlook – USDCHF, EURCHF, GBPCHF and NZDCHF

By:

USDCHF USDCHF’s aggression from June lows, as marked by ascending trend-channel formation, confronted the seven month old descending trend-line resistance

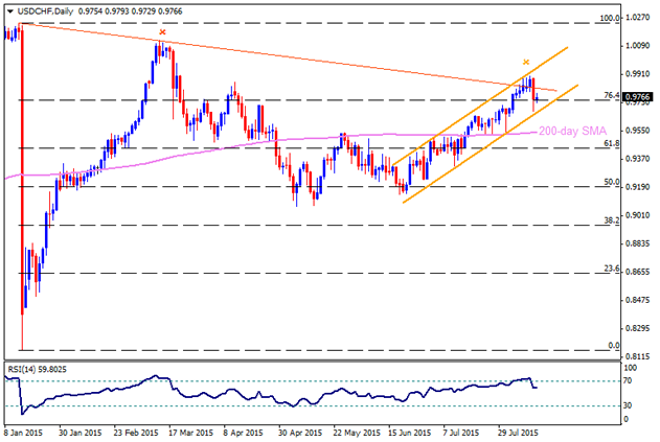

USDCHF

USDCHF’s aggression from June lows, as marked by ascending trend-channel formation, confronted the seven month old descending trend-line resistance during last week; however, the said channel resistance pulled back the pair by negating the breakout. Form the current level, channel support, near 0.9680-75, can become an immediate rest, breaking which the 200-day SMA, at present near 0.9540, is likely buffer for the pair’s downward trajectory towards 0.9440 and 0.9330-25 lower levels. Meanwhile, the said descending trend-line, near 0.9830, seems nearby resistance that can extend the pair’s up-move towards channel resistance, currently at 0.9950. Should the pair strengthens further above 0.9950, the 1.0100 – 1.0120 region, including March highs, is a tough nut to break before the pair could target its January levels above 1.0200 mark.

EURCHF

Having breached the ascending trend-line resistance, connecting highs marked in April, June and July, the EURCHF managed to surpass its February highs and close above 200-day SMA for the first time since January 2014; however, pair couldn’t sustain the break and seems pulling back towards 1.0830 and the February high of 1.0800. Should it continue declining below 1.0800, the resistance-turned-support line, presently near 1.0725, becomes an important support to determine the pair’s near-term moves, breaking which 1.0670 and the 1.0560-50 are likely consecutive levels to witness during the pair’s downturn. On the upside, 1.0920 and the recent highs of 1.0960 can become immediate resistances during the pair’s reversal while a sustained up-move beyond 1.0960, also surpassing the 1.1000 round figure mark, is likely targeting the 100% FE of the pair’s late-January February up-move, near 1.1250, before targeting the 1.1500 area.

GBPCHF

Three month old ascending trend-channel, coupled with short-term ascending trend-line support, keep favoring the GBPCHF up-move towards January highs of 1.5530-35 area; however, the said channel resistance could continue restricting the pair’s near-term advance. Should the pair manages to break 1.5535 on a closing basis, it could trigger the up-move towards 61.8% FE of its January-March up-move, near 1.5850. Moreover, an extended stretch beyond 1.5850 enables the pair to test 1.6000 psychological magnet. Alternatively, the ascending trend-line support, near 1.5170, and the 1.5040 are likely immediate supports to restrict its near-term decline, breaking which the 1.4800 – 1.4785 region, including the channel support, followed by the 200-day SMA & 76.4% Fibo of January decline, near 1.4700 – 1.4690, become important levels to limit further downside of the pair.

NZDCHF

NZDCHF’s bounce from 0.6200 area could gain limited fuel as the 0.6500 – 0.6510 horizontal mark restricted the pair’s advance, pulling it back towards 50-day SMA, 0.6400 area and the 0.6360-50 multiple support area. Should the pair continue declining below 0.6450, the 0.6285-80 can become an intermediate support before the pair re-test 0.6200 mark. Moreover, a daily close below 0.6200 mark can quickly test the 0.6050 mark prior to targeting 0.5900 support-zone. Should pair gathers enough of momentum to surpass 0.6510 on a closing basis, it can quickly rally to 0.6600 mark prior to targeting 0.6770-80 horizontal resistance area while an extended march beyond 0.6780 can provide considerable strength to the pair towards testing 0.6950-60 resistance zone.

Follow me on twitter to discuss latest markets events @Fx_Anil

About the Author

Anil Panchalauthor

An MBA (Finance) degree holder with more than five years of experience in tracking the global Forex market. His expertise lies in fundamental analysis but he does not give up on technical aspects in order to identify profitable trade opportunities.

Advertisement