Advertisement

Advertisement

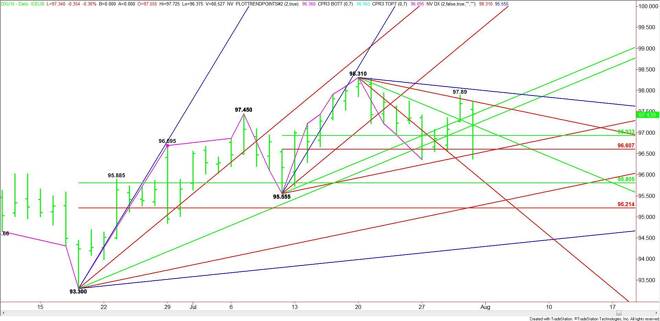

US Dollar Index (DX) Futures Technical Analysis – August 3, 2015 Forecast

By:

September U.S. Dollar Index futures had a volatile session on Friday. The market finished lower, but only after recovering more than half of its intraday

September U.S. Dollar Index futures had a volatile session on Friday. The market finished lower, but only after recovering more than half of its intraday decline. The price action represents trader indecision ahead of next Friday’s U.S. Non-Farm Payrolls report for July. This report is expected to show the economy added 224K new jobs.

This report is very important because the Fed is citing an improving labor market as one of the key reasons for a rate hike. A substantially higher number will be bullish for the dollar because it will likely mean the Fed will begin hiking rates in September. A lower than expected number will likely lead to a short-term sell-off since this will likely push a rate hike into December.

The main trend is up according to the daily swing chart. The short-term range is 95.555 to 98.31. Its retracement zone is 96.93 to 96.61. Trader reaction to this zone will likely determine the direction of the market over the near-term. The index has straddled this zone four out of the last five sessions.

The close over the 50% level at 96.93 gives the market an early upside bias. A sustained move over a pair of uptrending angles at 97.06 and 97.56 will signal the presence of buyers.

The first upside objective is a downtrending angle at 97.69. The next angle comes in at 98.00. This is the last major angle before the 93.31 main top.

Momentum will shift to the downside if the 50% level at 96.93 is taken out with conviction. This could trigger an acceleration into the Fibonacci level at 96.61. This is followed closely by an uptrending angle at 96.56. The daily chart opens up further to the downside under 96.56 with the next target a 50% level at 95.80.

Based on the close at 97.44, the early direction of the day will be determined by trader reaction to angles at 97.69 and 97.56. Look for a bullish tone to develop on a sustained move over 97.69 and a bearish tone on a sustained move under 97.56.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement