Advertisement

Advertisement

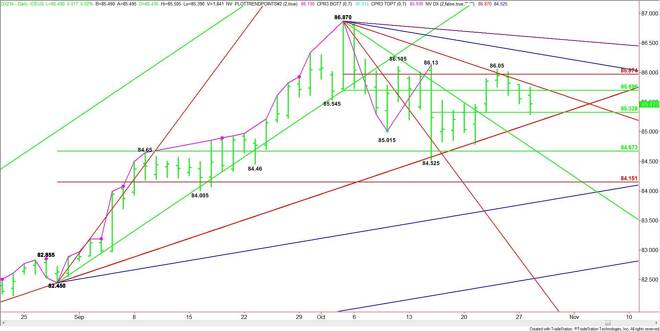

US Dollar Index (DX) Futures Technical Analysis – October 29, 2014 Forecast

By:

The December U.S. Dollar Index futures contract weakened for a third consecutive day as many traders squared positons and took to the sidelines ahead of

The December U.S. Dollar Index futures contract weakened for a third consecutive day as many traders squared positons and took to the sidelines ahead of today’s U.S. Federal Open Market Committee meeting.

The Fed is expected to announce the end to its quantitative easing program and leave interest rates unchanged. It’s not what the Fed is going to do that is important today, but what it says in the statement. Topics that may be mentioned include the effects of the weak Euro Zone economy on the U.S. recovery, the impact of the strong U.S. Dollar on the economy and falling energy prices as they pertain to inflation.

The main range is 86.87 to 84.525. Its retracement zone at 85.70 to 85.97 has been providing resistance since October 23. Last week’s high at 86.05 and subsequent sell-off was essentially a successful test of the upper or Fibonacci level at 85.97.

Currently, the market is trading below the lower, or 50% level at 85.70 and a downtrending angle from the contract high at 85.75. Look for weakness as long as these levels hold as resistance.

A breakout over 85.75 could trigger a fast rally into the upper, or Fibonacci level at 85.97, followed by a downtrending angle at 86.31.

The short-term range is 84.525 to 86.05. Its mid-point at 85.33 is currently controlling the short-term direction of the market. A failure to hold this pivot price will put the market in a weak position and could lead to a test of the major long-term uptrending angle at 85.20.

The daily chart opens up under 85.20 with a major long-term 50% level at 84.67 the primary downside target.

Look for volatility late in the session, following the release of the Fed statement especially if the central bank specifically mentions the dollar. Watch for sideways action inside the two 50% levels at 85.70 and 85.33.

Look for a bullish tone on a move over 85.75 and a bearish tone under 85.20.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement