Advertisement

Advertisement

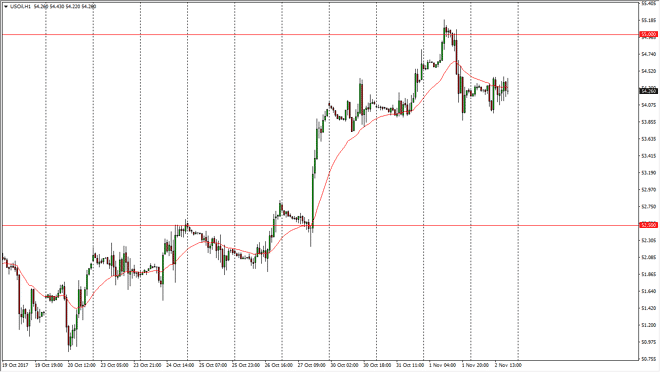

WTI Crude Oil Price Forecast November 3, 2017, Technical Analysis

Updated: Nov 3, 2017, 05:19 GMT+00:00

WTI Crude Oil The WTI Crude Oil market went sideways during the session on Thursday, as we continue to hang about the $54 level. I think that the jobs

WTI Crude Oil

The WTI Crude Oil market went sideways during the session on Thursday, as we continue to hang about the $54 level. I think that the jobs number will be a massive influence on what happens next in the oil markets, with the $55 level above being massively resistive. The US dollar of course has its own influence on crude oil, as a stronger US dollar typically brings down the value of oil. When I look at the daily chart, we formed a significant shooting star for Wednesday, and that suggests that we could roll over. If we break down below the $53.90 level, I think the market probably drops down to the $52.50 level underneath. Alternately, if we make a fresh, new high, the market should then go towards the $60 level.

Crude Oil Inventories Video 03.11.17

Brent

Brent markets were very choppy during the trading session on Thursday as well, as the $60 level underneath should offer support. If we can break down below the $60 level, the market should then go to the $58.50 level, as it is the next support of level. If we break above the highs from the Thursday session, that would be very bullish move, but I suspect that we will see is more volatility than anything else. I anticipate the waiting for a daily close is probably the best way to go, as the jobs number continues to be a main driver and volatility when it comes to the greenback. By being patient, you should get more clarity than what you will have available to you early in American trading, which is when we will get the announcement. Expect a lot of noise, but ultimately, we should get a stronger signal on the daily close.

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement