Advertisement

Advertisement

Bank of Canada hints at more aggressive pace as it hikes rates

By:

By Julie Gordon OTTAWA (Reuters) - The Bank of Canada will almost certainly go ahead with its second consecutive half-point interest rate hike on Wednesday, as it scrambles to tame runaway inflation before price increases become self-fulfilling. The big mystery is what happens next.

By Julie Gordon and Ismail Shakil

OTTAWA (Reuters) – The Bank of Canada opened the door to a more aggressive pace of tightening on Wednesday, saying it was prepared to act “more forcefully” if needed to tame inflation, even as it went ahead with a historic second consecutive 50-basis-point rate increase.

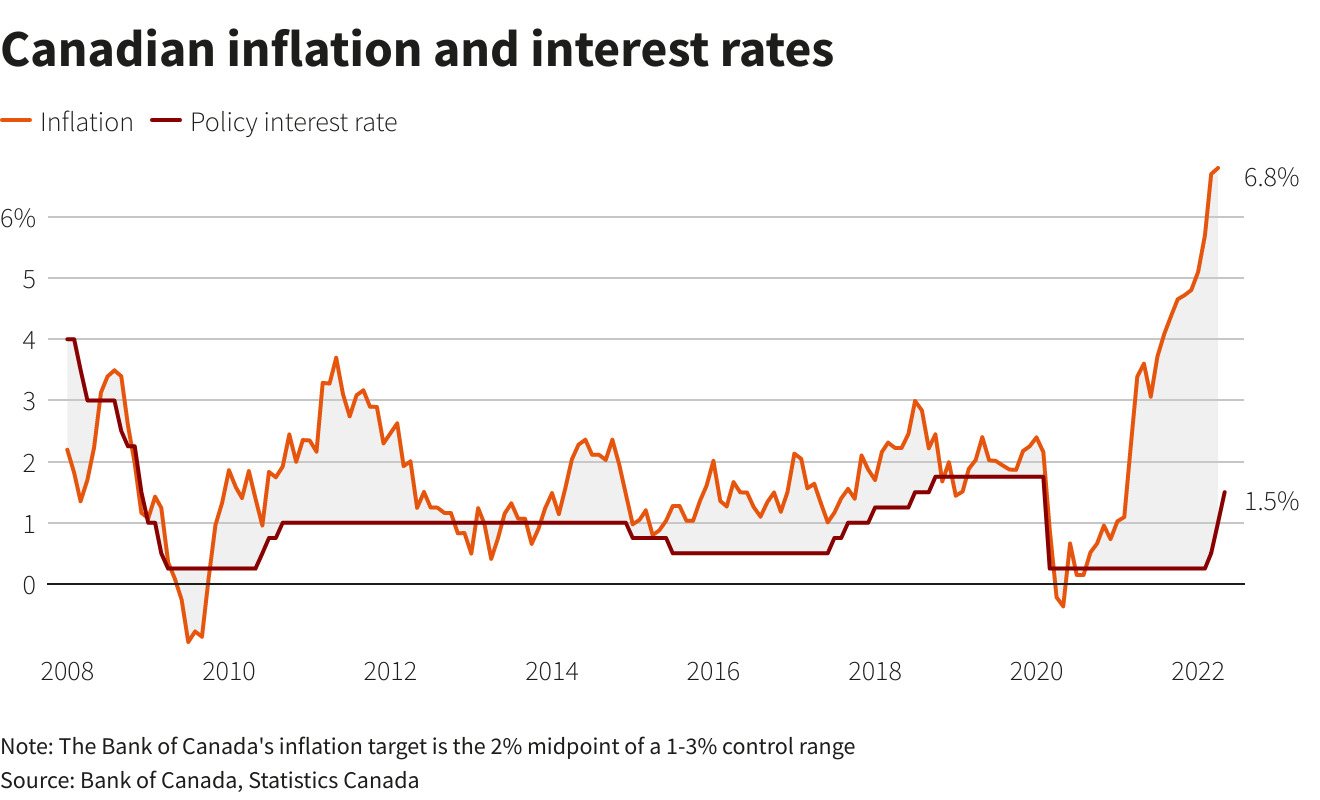

Canada’s central bank lifted its policy rate to 1.5% from 1.0%, inking its first back-to-back oversized increase since inflation targeting began in the early 1990s. It also warned price increases could persist in the near-term, so higher rates would be needed.

“The risk of elevated inflation becoming entrenched has risen. The Bank will use its monetary policy tools to return inflation to target and keep inflation expectations well-anchored,” the central bank said in the decision statement.

“Governing Council is prepared to act more forcefully if needed to meet its commitment to achieve the 2% inflation target,” it added.

Governor Tiff Macklem has not ruled out a 75-basis-point or larger increase to curb inflation. He has also said the policy rate could go above the 2%-3% neutral range for a period, if needed.

Canada’s inflation rate edged up to 6.8% in April, a three decade high and surging gas prices could help send May’s rate higher. If left unchecked, the Bank risks a price spiral, making getting back to the 2% target even harder.

“The overall tone is above and beyond hawkish,” said Doug Porter, chief economist at BMO Capital Markets, adding the central bank could be hinting at a larger than 50-bps move at their next decision in mid-July to tame price increases.

“Clearly they underestimated inflation even as recently as the past meeting, and they’re basically trying to make up for lost time now,” Porter said.

Money markets have already priced in a unprecedented third-consecutive 50-bps increase in July, with rates seen around 3% by year-end.

The Canadian 2-year yield touched a two-week high at 2.827% before dipping to 2.798%, up 13.3 basis points on the day, while the Canadian dollar was trading nearly unchanged at 1.2641 to the U.S. dollar, or 79.11 U.S. cents, as the greenback rallied against a basket of major currencies.

The Bank of Canada said the economy “clearly” operating in excess demand, and noted robust consumer spending and stronger exports would drive solid growth in the second quarter.

But it also noted Canada’s housing market was moderating. That could force the central bank hold off on a 75-bp move at its next decision, said economists.

“We don’t think the data will justify such a move with the housing market already reacting negatively to higher rates,” said Royce Mendes, head of macro strategy at Desjardins Group.

(Reporting by Julie Gordon and Ismail Shakil in Ottawa; additional reporting by David Ljunggren in Ottawa and Fergal Smith in Toronto; Editing by Kirsten Donovan and David Gregorio)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement