Advertisement

Advertisement

Column-‘TINA’ still driving hedge funds’ bullish dollar view: McGeever

By:

By Jamie McGeever ORLANDO, Fla. (Reuters) - Being long dollars will no doubt become an overcrowded trade at some point and a reversal will ensue, but for hedge funds right now, there is no alternative.

By Jamie McGeever

ORLANDO, Fla. (Reuters) – Being long dollars will no doubt become an overcrowded trade at some point and a reversal will ensue, but for hedge funds right now, there is no alternative.

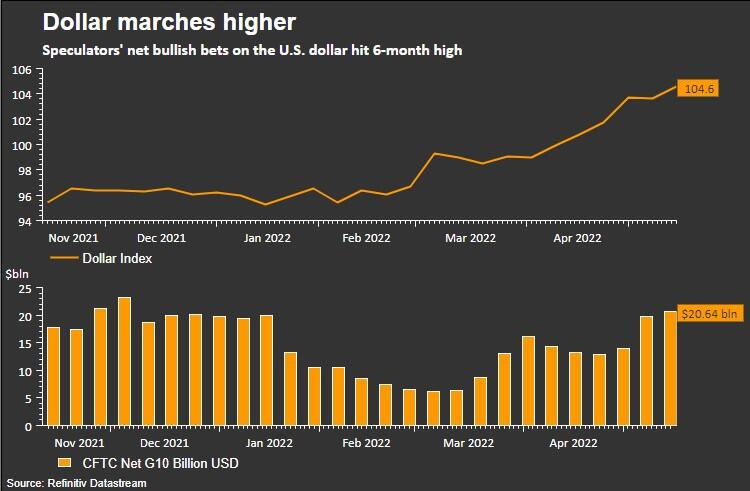

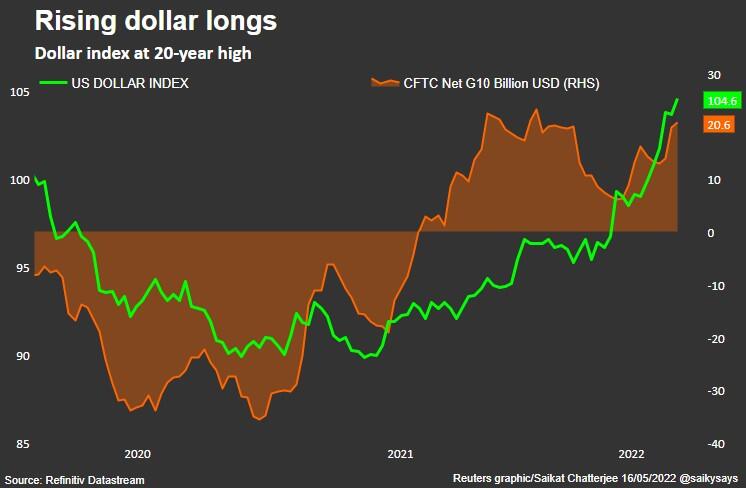

Funds have amassed their biggest bet in six months that the dollar will strengthen against the world’s major currencies, and you can understand why.

From widening interest rate and yield spreads, favorable relative growth prospects, and safe-haven flows amid exploding equity- and crypto-fueled market volatility, there are many factors behind the greenback’s ascent to a 20-year peak.

The latest Commodity Futures Trading Commission data show that funds increased their net long dollar position against G10 currencies to $20.6 billion in the week to May 10 from $19.8 billion the week before.

That is the biggest net long position since early December last year. The bullishness is broad-based – funds are long dollars against all major currencies except the euro, and that short position is very small by historical standards.

A long position in an asset or security is effectively a bet that it will rise in value, and a short position is the opposite.

The dollar index, a measure of the greenback’s value against a basket of major currencies, rose above 104.00 on May 9 for the first time since December 2002, lifted by the Federal Reserve’s half-percentage-point rate hike and a pledge from Fed Chair Jerome Powell that further 50-basis-point moves are coming.

$6 BILLION BET AGAINST STERLING

Analysts at Goldman Sachs estimate that the dollar is over-valued by 18% but are cautious on calling for a correction, while analysts at Barclays note that the dollar looks stretched but raised their forecasts regardless.

“More expensive for longer,” Barclays wrote on Monday.

There’s a debate to be had about how much the Fed will ultimately tighten – the terminal rate implied by pricing on the Secured Overnight Financing Rate (SOFR) has fallen to 3% from almost 3.50% on May 4, the day of the Fed’s policy decision – but most observers believe it will still be significantly more aggressive than its peers.

For example, the Bank of England also raised rates again this month, but warned of recession risks and the possibility of double-digit inflation. This was not what sterling wanted to hear, and its downdraft accelerated sharply.

CFTC funds have consistently been short the pound since mid-November, apart from the week before Russia invaded Ukraine in February. They have been short every week since – that bet is now worth more than $6 billion – and on Friday sterling hit a two-year low of $1.2155.

The European Central Bank is steering markets towards a likely rate hike in July, but the hawkish noises are being utterly drowned out by recession alarm bells. The euro’s slide towards parity with the dollar is starting to worry ECB officials.

CFTC funds flipped back long euros in the latest week, a week-on-week position swing of almost $3 billion. But those longs will have been crushed by the currency’s slump to as low as $1.0350.

Derek Halpenny at MUFG reckons the euro’s 2017 low of $1.0340 is the last line of defense before $1.00 and the first time at parity since 2002. If hedge funds are thinking along the same lines, they may might be flipping to a net short euro position soon enough.

Related columns:

Stirring ingredients of 1985’s dollar-capping Plaza Accord (Reuters, May 11)

Sterling tailspin as BoE maps 10% inflation and recession (Reuters, May 6)

Fed fingers crossed for 1994 re-run as hiking path shortens (Reuters, May 5)

Fraying central bank consensus spurs dollar and market stress (Reuters, May 4)

(The opinions expressed here are those of the author, a columnist for Reuters)

(By Jamie McGeever; Graphics by Saikat Chatterjee, Joice Alves and Karen Brettell; Editing by Paul Simao)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement