Advertisement

Advertisement

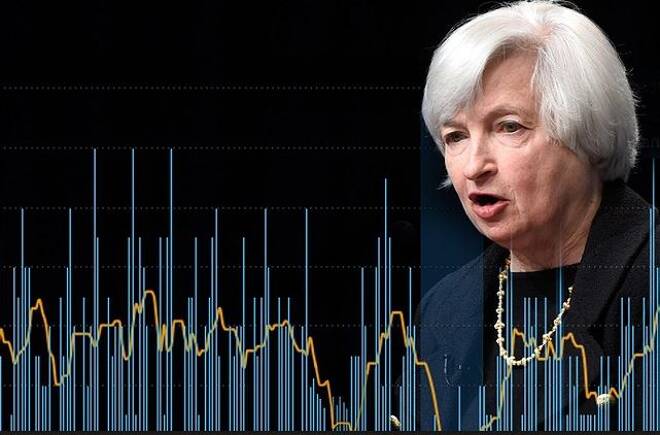

Delays in Trump’s Agenda, Debt-Ceiling Will Force Fed to Pass on September Rate Hike

By:

Federal Reserve policymakers are widely expected to increase the target for the federal funds rate from 1% to 1.25% on Wednesday. Traders are pricing in

Federal Reserve policymakers are widely expected to increase the target for the federal funds rate from 1% to 1.25% on Wednesday. Traders are pricing in close to a 100% chance of this happening so any surprises will be to the downside.

Since last December, the Fed has been expected to raise the policy rate another 25 basis points in September and to start gradually unwinding its portfolio of mortgage-backed-securities and Treasuries in December. However, that was before Treasury Secretary Steven Mnuchin announced that Congress would have to raise the debt ceiling before its summer recess.

With limited time between the summer recess and the Fed’s meeting in September, the central bank rate increase is likely to be delayed until Congress and the Trump administration sort out the deals and agree on funding for the government past the end of the fiscal year.

However, once the Fed gets over this hump, the central bank is likely to continue the process of tightening with another rate hike in December.

Also supporting the case for skipping a September rate hike is the Trump administration’s failure to implement any of its economic agenda because of a series of distractions bogging down the presidency.

Shortly after President Trump won the election, he promised to reform taxes, reduce banking regulations and spend $1 trillion dollars are improving the infrastructure. It’s June 12 and all of these economic events appear to be in jeopardy.

If the Fed included any or all of these events in their economic and interest rate forecasts then they are going to have to reduce expectations for multiple rate hikes in 2017. The easiest way to do this is to take a pass on the September rate hike. This would be the prudent thing to do especially if tax reform fails to get passed before the summer recess.

Some investors are saying it’s the weakening economy that will convince the Fed to restrain itself from multiple rate hikes later this year, but I believe it’s the delays in implementing the Trump economic agenda and deficit spending.

The labor market is strong. Inflation is steady but struggling. So the Fed has done its part. However, the government’s inability to control fiscal spending and push through attempts to grow the economy are going to force the Fed to step back and re-evaluate its interest rate forecast.

After the Fed raises rates on Wednesday, it will release its monetary policy statement and hold a press conference. I expect the central bank to take the September rate hike off the table and push for a December rate hike and the start of the unwinding its balance sheet.

The market will be looking for this from the Fed. If they leave a September and December rate hike in their forecast then we could see a sharp rise in the U.S. Dollar.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement