Advertisement

Advertisement

Economic Data and Geopolitics Put the Loonie and the Pound in the Spotlight

By:

Retail sales figures put the Loonie and the Pound in focus, with Brexit another driver for the Pound on the day.

Earlier in the Day:

It’s was a quieter start to the day on the economic calendar this morning. The Japanese Yen was in action.

For the Japanese Yen

In August, the annual core rate of inflation fell by 0.4% in August, which was in line with forecasts. Inflation had stalled in July.

According to the Ministry of Internal Affairs and Communication, the annual rate of inflation softened from 0.3% to 0.2% in August.

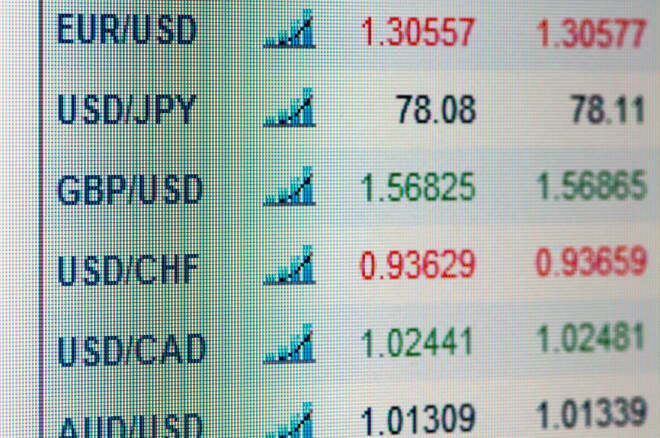

The Japanese Yen moved from ¥104.724 to ¥104.731 upon release of the figures. At the time of writing, the Japanese Yen was up by 0.02% ¥104.72 against the U.S Dollar.

Elsewhere

At the time of writing, the Aussie Dollar was up by 0.18% to $0.7326, with the Kiwi Dollar up by 0.33% to $0.6777.

The Day Ahead

For the EUR

It’s another relatively quiet day ahead on the economic calendar. Key stats include August wholesale inflation figures for Germany.

Following the Eurozone’s figures from Thursday, disappointing numbers would be a test for the EUR early in the day.

Away from the economic calendar, however, market risk sentiment will remain a key driver on the day. Brexit and concerns over the global economic recovery will likely linger if economic data disappoints through the day.

At the time of writing, the EUR was up by 0.07% to $1.1856.

For the Pound

It’s a busy day ahead on the economic calendar, with August retail sales figures in focus later this morning.

Following the BoE’s uncertain outlook on the economy and the talk of negative rates, we can expect Pound sensitivity to the numbers.

With the UK government having to reintroduce containment measures and Brexit uncertainty ever-present, the Pound remains under pressure.

On the Brexit front, updates on the passage of the Internal Market Bill will also continue to influence.

At the time of writing, the Pound was up by 0.08% to $1.2984.

Across the Pond

It’s a relatively quiet day ahead for the U.S Dollar. Key stats include prelim September consumer sentiment figures from the U.S.

With the FED’s dovish outlook on the economy, a pickup in consumer sentiment at the end of the quarter would ease the pain.

Away from the economic calendar, geopolitics will also influence.

The Dollar Spot Index was down by 0.10% to 92.877 at the time of writing.

For the Loonie

It’s a busier day ahead, with August retail sales and wholesale sales figures in focus later today.

We can expect the retail sales figures to be the key driver on the day.

Barring impressive numbers, however, expect the recently dovish central bank chatter to limit any upside.

At the time of writing, the Loonie was up by 0.08% to C$1.3156 against the U.S Dollar.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement