Advertisement

Advertisement

First Republic shares tumble again as liquidity fears linger

By:

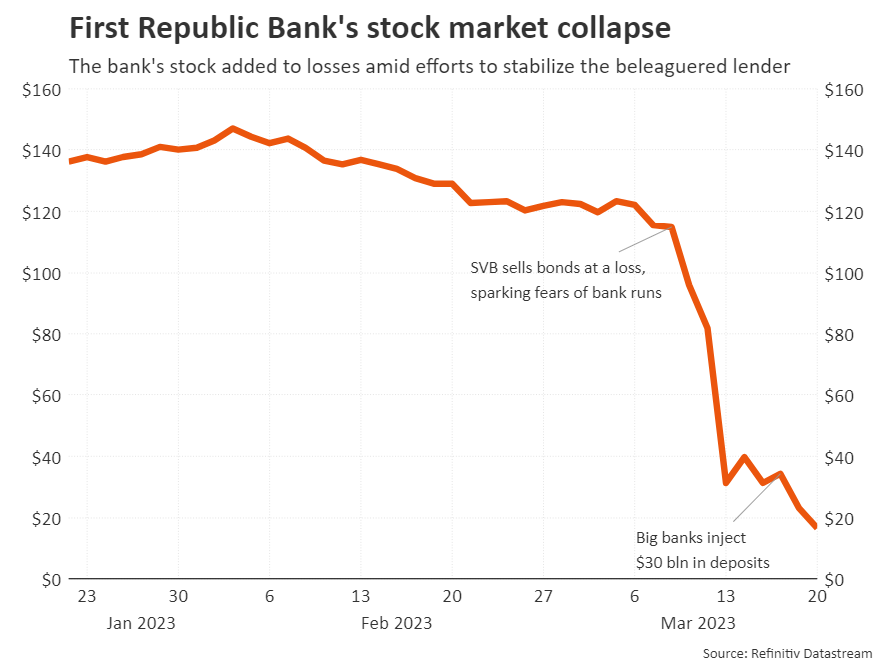

(Reuters) - Shares of First Republic Bank slumped 16% on Monday, leading losses among U.S. lenders in premarket trading, after a report the regional bank could raise more money fanned worries about its liquidity despite a $30 billion rescue last week.

By Medha Singh and Ankika Biswas

(Reuters) – Shares of First Republic Bank closed 47% lower on Monday, adding to recent losses as concerns about its liquidity continued to worry investors despite a $30 billion influx of deposits last week.

The bank’s stock fell as much as 50% and closed at $12.18 after the New York Stock Exchange halted it several times due to volatility.

S&P Global downgraded First Republic deeper into junk status on Sunday and said the recent cash infusion from 11 large U.S. banks last week may not solve its liquidity problems.

“We do not view this deposit infusion–which has an initial maturity of 120 days–as a longer-term solution to the bank’s funding issues,” S&P wrote. “We think attracting meaningful deposits will be difficult, constraining the bank’s business position.”

Large U.S. banks injected $30 billion in deposits into First Republic Bank on Thursday, swooping in to rescue the lender caught up in a widening crisis triggered by the collapse of two other mid-size U.S. lenders over the past week.

The fresh deposits did not halt the slide in its shares, however. First Republic Bank is among the banks that have been speaking to peers and investment firms about potential deals in the wake of U.S. regulators taking over Silicon Valley Bank and Signature Bank this month amid a flight of depositors, sources have said.

Regional banks that are under pressure could be taken over by stronger rivals, or they could seek cash infusions from investors such as private equity firms, the industry sources said last week. Two sources familiar with the matter said that all options are on the table for First Republic, which could include a sale or equity infusion, the sources said, confirming previous reports.

Market value plummets

JPMorgan Chase & Co is advising First Republic on its options to raise capital from investors, a source familiar with the situation said.

First Republic declined to comment on the potential share sale.

“Following Thursday’s uninsured deposit of $30 billion by the 11 largest banks in the country, together with cash on hand, First Republic Bank is well positioned to manage short-term deposit activity,” the company said in a statement.

The support “reflects confidence in First Republic and its ability to continue to provide service to its clients and communities,” the lender said.

The large banks that contributed deposits to First Republic could potentially withdraw some of the funds and take equity stakes instead, said a legal expert who declined to be identified. But the person stressed that deposits cannot be converted into equity.

The Wall Street Journal reported on Monday that JPMorgan CEO Jamie Dimon is leading talks with the chiefs of other big banks about fresh efforts to stabilize the San Francisco-based bank, citing people familiar with the matter.

JPMorgan and First Republic declined to comment on the report.

“The market wants a more conclusive resolution for what’s going to happen to First Republic and the only way out of that is some sort of asset sale,” said Matt Orton, chief market strategist at Raymond James Investment Management.

First Republic’s stock market value has collapsed by over 80% in the past 10 trading sessions due to fears of a bank run as a large proportion of the lender’s deposits are uninsured.

Short sellers in First Republic made about $560 million profit on paper since last Monday, analytics firm Ortex said.

Shares of other U.S. lenders largely rebounded on Monday in tandem with their European peers as UBS Group’s state-backed takeover of troubled peer Credit Suisse Group AG appeared to allay worries that the recent banking crisis could spread further.

The deal announcement “should both ease contagion fears but also meaningfully reduce the counter-party concerns for U.S. universal banks,” said KBW analyst David Konrad.

The S&P 1500 regional banks index rebounded 0.5% after sharp declines in recent days.

PacWest Bancorp climbed almost 11% after the bank said deposit outflows had stabilized and its available cash of more than $10.8 billion exceeded total uninsured deposits.

“We have increased confidence that PACW can make it through this liquidity crunch now that it has enough cash to cover any additional run-off in uninsured deposits,” Matthew Clark, managing director at Piper Sandler & Co said in a note.

A U.S. official told Reuters on Sunday that the deposit outflows that left many regional banks reeling in the wake of Silicon Valley Bank’s failure had slowed and in some cases reversed.

New York Community Bancorp Inc surged 32% after its subsidiary agreed with U.S. regulators to buy deposits and loans from the shuttered New York-based Signature Bank.

Western Alliance Bancorp fell 6.7%, while Fifth Third and U.S. Bancorp both rallied more than 4%.

(Reporting by Medha Singh and Ankika Biswas in Bengaluru; additional reporting by Noel Randewich in Oakland, Calif., Greg Roumeliotis, Megan Davies, Lananh Nguyen, Saeed Azhar and Tatiana Bautzer in New York; Editing by Sriraj Kalluvila and Aurora Ellis)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement