Advertisement

Advertisement

Defensives drag down UK’s benchmark index, inflation surges

By:

(Reuters) - UK's top share index hit a three-week high on Wednesday, lifted by oil and mining stocks, as investors bet on a bigger than usual interest rate hike by the Bank of England next month after data showed inflation hit a fresh 40-year high.

By Sruthi Shankar and Bansari Mayur Kamdar

(Reuters) – UK’s top share index reversed early gains and fell on Wednesday, dragged lower by a weakness in defensive stocks, while a surge in inflation to 40-year highs cemented bets for a bigger-than-usual rate hike by the Bank of England next month.

The FTSE 100 fell 0.4%, after rising as much as 0.7%, as healthcare and consumer staples stocks such as Astrazeneca, British American Tobacco and Unilever weighed on the blue-chip index.

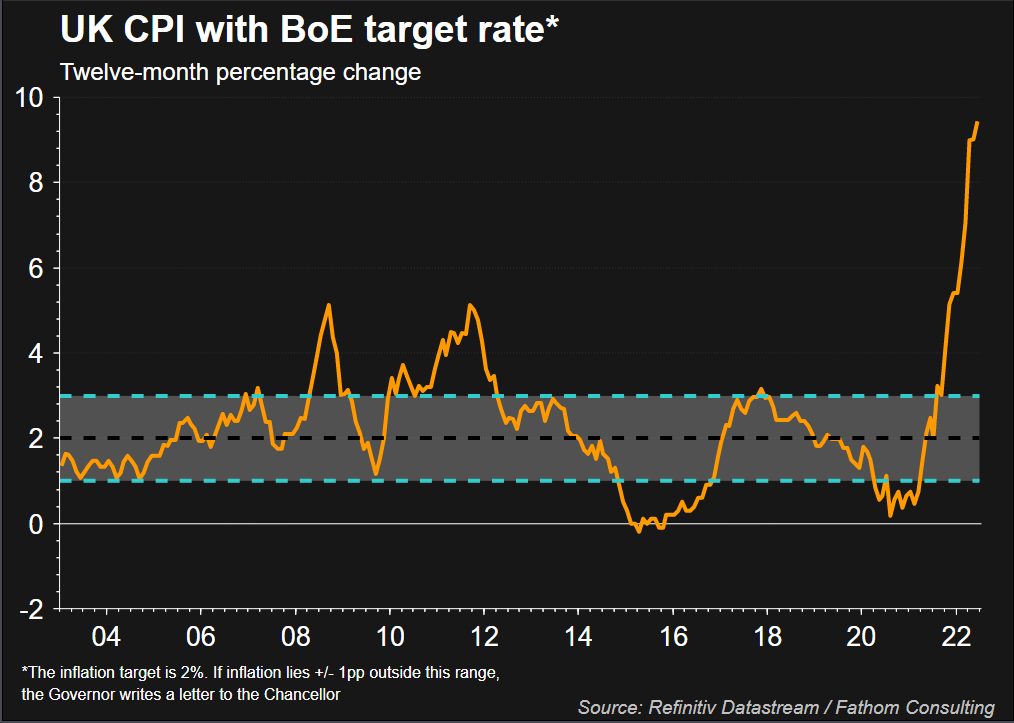

British consumer prices surged in June to hit an annual rate of 9.4%, the highest since early-1982, according to official figures that bolstered the chances of a rare half percentage-point rate increase in August.

“The intense cost of living squeeze is putting significant pressure on the UK’s consumer-led economy and means the risk of recession is high,” Hussain Mehdi, Macro & Investment Strategist at HSBC Asset Management, said.

“Nevertheless, the Bank of England is likely to remain in uber-hawkish mode as it attempts to counter the risk of a wage-price spiral developing with recent data suggesting a still hot labour market that is contributing to domestic inflationary pressures.”

European shares fell 0.2% as uncertainty swirled around gas supplies to the region and the future of Italian Prime Minister Mario Draghi, while investors also focused on the European Central Bank meeting on Thursday. [MKTS/GLOB]

Advertising firm WPP gained 2.2% after U.S. rival Omnicom Group reported stronger-than-expected quarterly results.

The domestically focussed midcap index rose 0.6%, hitting its highest in three weeks.

Morses Club PLC tumbled 42.3% after the subprime lender said it was pursuing a potential use of the so-called scheme of arrangement to deal with the high levels of redress claims that threaten to jeopardise its future.

Traders also eyed the race to replace Boris Johnson as former finance minister Rishi Sunak and foreign secretary Liz Truss made the final two candidates to become Britain’s next prime minister.

(Reporting by Sruthi Shankar and Bansari Mayur Kamdar in Bengaluru; editing by Uttaresh.V and Angus MacSwan)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement