Advertisement

Advertisement

Global Oil Over Supply Push Prices Lower

By:

Crude oil prices remain near the bottom of their trading ranges but had small gains on Monday. Tuesday morning energy speculators reversed course as the

Analysts said that despite the Paris attacks and resulting French airstrikes in Syria, prices would remain low for the rest of the year and into 2016 as oil markets stay oversupplied, with most estimates for 2015 ranging from production outpacing demand by 0.7-2.5 million barrels per day.

Many speculators are even positioning themselves for further price falls.

France carried out air strikes overnight in Syria against Islamic State, which claimed responsibility for the Paris attacks, and on Monday called on the United States and Russia to join a global coalition to overcome the group.

Oil price gains were limited, however, in a day that saw prices switch from positive to negative and back again, as traders sought to make sense of what the attacks and their aftermath might mean for oil supply and demand, Reuters reported.

While geopolitical tensions in the oil-producing Middle East tend to be a bullish factor for oil because of potential disruptions to supply, many expected that the Paris attacks would crimp economic activity in Europe, in part by reducing travel on the continent. Brent crude rose less than US crude on Monday.

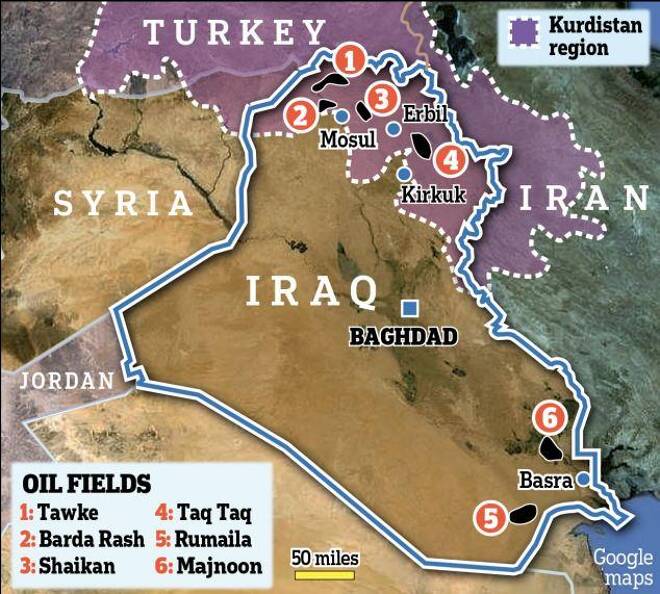

An OPEC delegate from a Gulf oil-producing nation said he believed that oil prices could gain some support in the medium term from rising tensions, particularly if the international community steps up measures to reduce oil smuggling and hits oil facilities under Islamic State’s control in Syria and Iraq.

It wasn’t the Paris attacks but news from OPEC. Output from the cartel fell in October, its third monthly decline in a row.

Money managers cut their net long US crude futures and options positions to the lowest in three months during the week to Nov. 10, the US Commodity Futures Trading Commission (CFTC) said on Monday.

The speculator group cut its combined futures and options position in New York and London by 27,456 contracts to 127,351 during the period. The cut in bets on higher prices has come in parallel to soaring amounts of contracts actively betting on a further fall in oil. US crude oil prices have now been lower than $50 per barrel for longer than they were during the height of the global credit crunch in late 2008/early 2009, when they were under that level for 74 straight days and another 14 intermittent days before and after.

For the first time since 2009, the national average for a gallon of regular gasoline will drop below the $2 mark. That’s the prediction being made this week by AAA, which states that due to factors including a “bearish sentiment” on global petroleum prices and normal early winter declines in demand for gas, “pump prices are expected to move lower to close out the year, barring any unanticipated outages or supply disruptions.”

About the Author

Barry Normanauthor

Advertisement