Advertisement

Advertisement

Japan yields tumble to well below policy cap as BOJ stands pat

By:

By Kevin Buckland TOKYO (Reuters) - Japanese government bond yields punched above the central bank's 0.5% policy ceiling for a fourth straight session on Wednesday, ahead of one of the most highly anticipated monetary policy decisions globally in years.

By Kevin Buckland

TOKYO (Reuters) – Japanese government bond yields tumbled, falling the most in two decades at one point on Wednesday, retreating sharply from the central bank’s 0.5% ceiling after policymakers decided to keep yield curve controls in place.

The 10-year yield plunged as much as 14 basis points to 0.36% at its lowest point, which would have been the biggest one-day decline since September 2003, before edging back up to 0.41% as of 0733 GMT. The yield was at 0.51% prior to the Bank of Japan decision.

Anticipation had been high that BOJ Governor Haruhiko Kuroda and his colleagues would change tack at Wednesday’s meeting, with expectations ranging from further tweaks to yield curve control (YCC) to complete abandonment.

Ten-year JGB futures jumped when they resumed trading following the midday break, trading up as much as 1.81 points to 146.65, the highest since Dec. 20. They had dipped to 144.15 on Friday, the lowest since March 2014.

“If they had expanded the band again or terminated YCC, yields would rise, which would be a de facto rate hike for a second consecutive meeting,” said Naomi Muguruma, senior market economist at Mitsubishi UFJ Morgan Stanley Securities. “That’s not the intention of the policy board.”

The BOJ also made use of a newly announced policy tool immediately, offering five-year loans to financial institutions to enhance liquidity, and showing its resolve to keep yields low.

The yen retreated as much as 2.6% to 131.58 per dollar on Wednesday, reversing a rally that was driven by bets BOJ stimulus was on the way out, which had pushed Japan’s currency to its highest since May.

Japan’s Nikkei 225 share average closed the day with a 2.5% rally, its best performance since Nov. 11.

While it has been only a month since the BOJ doubled the allowable band for the 10-year yield around its 0% policy rate – ostensibly to improve market function – the change had emboldened speculators to test the bank’s resolve.

The 10-year yield has breached the BOJ’s ceiling in each of the past three trading sessions, only to close back at the 0.5% limit each day. On Friday, it spiked to a 7-1/2-year peak of 0.54%.

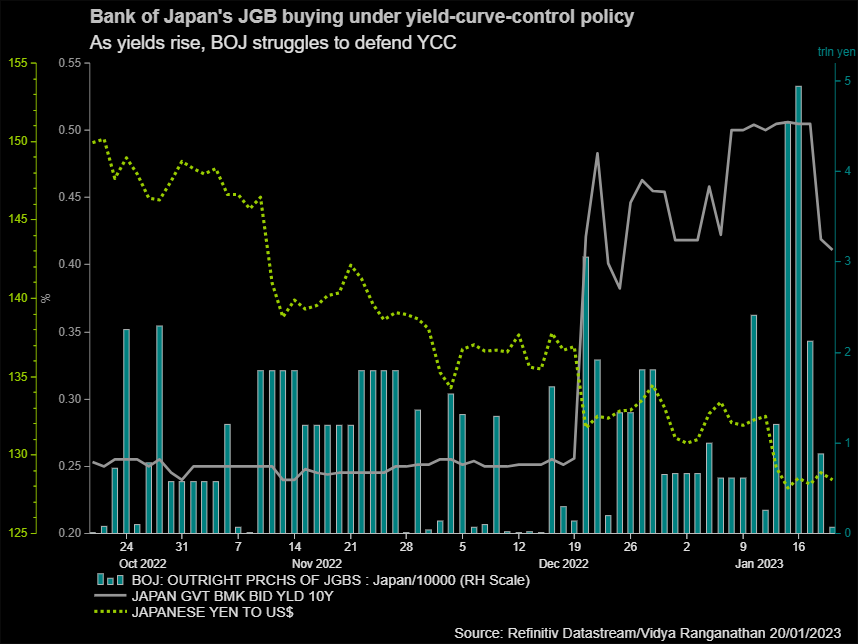

Taming yields has come at a cost, with the central bank splashing an unprecedented 10 trillion yen ($78 billion) on bond buying operations on Friday and Monday, calling into question the sustainability of the programme.

At the post-meeting press conference, Kuroda defended the change, reiterating that widening the yield band has made YCC “fully sustainable”. He added he didn’t see any “special risk” associated with the BOJ’s recent increase in bond purchases.

Signs that ultra-easy monetary policy may not be needed for much longer have come from consumer inflation, which in the most recent data for Tokyo was double the 2% target, and from early indications from corporate Japan that stubbornly slow-to-rise salaries may also take off.

“Inflation dynamics are changing gradually, and the necessity to keep the current uber-accomodative monetary policy framework is declining,” said Masayuki Kichikawa, chief macro strategist at Sumitomo Mitsui Asset Management.

“Still, there is no reason to remove it in a rush.”

($1 = 128.2200 yen)

(Reporting by Kevin Buckland; Additional reporting by Ankur Banerjee and Rae Wee; Editing by Sam Holmes, Edmund Klamann and Jamie Freed)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Advertisement