Advertisement

Advertisement

Political pitfalls to test markets’ comfort over French election

By:

By Leigh Thomas and Dhara Ranasinghe PARIS (Reuters) - Financial markets are more sanguine about France's presidential election than they were five years ago, even though political risks are higher now no matter who wins.

By Leigh Thomas and Dhara Ranasinghe

PARIS (Reuters) – Financial markets are more sanguine about France’s presidential election than they were five years ago, even though political risks are higher now no matter who wins.

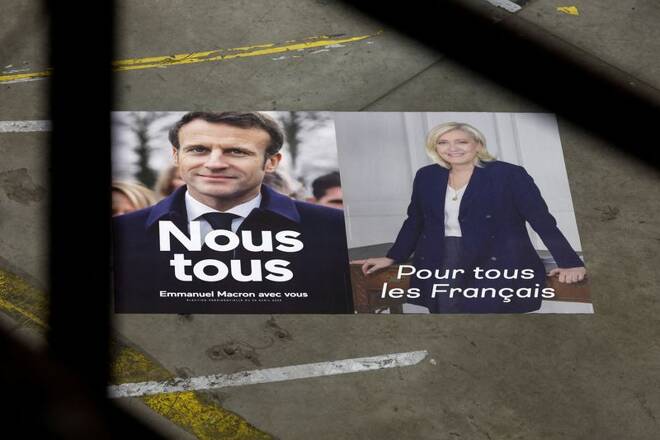

Far-right leader Marine Le Pen has never been closer to power even though polls suggest incumbent Emmanuel Macron will win a second term in Sunday’s runoff vote against her, although by a much smaller margin than in 2017.

Even if Macron defeats Le Pen, he cannot count on easily winning a new majority in June parliamentary elections. Le Pen also cannot expect a parliamentary majority, but her victory could trigger constitutional and institutional crises.

Nonetheless, financial markets are more relaxed this time with the premium investors demand to own French bonds over the German benchmark now at 45 basis points, well below the 75 bps seen in 2017. The euro, trading at $1.0860, is above levels seen in the run-up to the 2017 vote.

“The big difference this time is that Le Pen has softened her anti-EU and anti-euro rhetoric, which is what spooked markets so much last time around,” said Mike Riddell, head of macro unconstrained at Allianz Global Investors in London.

Though she has toned down her campaigning, there is no shortage of initiatives that could put a president Le Pen on a collision course with Paris’ EU partners and France’s courts.

Promises to scrap income tax on under 30-year-olds or impose a “national preference” for French citizens to receive welfare, benefits, social housing and even jobs could fall foul of the constitutional court.

Costly plans to nationalise motorways and cut value added tax on energy would weigh heavily on the budget deficit, leaving little chance of it falling below 5% of GDP in the medium term – well above the European Union’s 3% ceiling, Societe Generale said.

“Such an increase in deficits and debt would undoubtedly lead to tensions with the EU,” the French bank’s analysts said in a research note.

Endorsing Macron for a new five-year term, the MEDEF employers’ federation said that France would fall behind its neighbours under Le Pen and become marginalised in the EU.

“The big and unfinanced increase in public spending risks putting the country in an impasse,” the MEDEF warned after the first round of voting.

Parliamentary elections

No matter who wins the presidential election, victory could prove short-lived with legislative elections in June key to whether the president has enough leeway to govern effectively.

Political scientist Martial Foucault, whose Cevipof institute leads the largest poll on the presidential election, said that Le Pen simply could not field enough viable candidates to win an absolute majority.

That would leave her with few choices other than to try to find a prime minister capable of governing with an “impossible coalition”, he said.

But even if Macron is re-elected president, he too will likely struggle to secure a viable majority without relying on support from fickle allies. ‘

“If he doesn’t get a majority in the parliamentary election, that is also problematic,” said Francois Savary, chief investment officer at Swiss wealth management firm Prime Partners.

“So the question about paralysis is not just about Le Pen but also connected to the parliamentary election, which could be key and impose restrictions on Macron too.”

Macron can expect fierce opposition from the camp of hard-left presidential candidate Jean-Luc Melenchon, who showed he has support from a sizeable block of voters when he came in third in a first round of the presidential vote, just behind Le Pen.

At home, a fragile political base would spell trouble for Macron’s plans to pass an unpopular overhaul of the pension system while internationally it would weaken his hand for broader European initiatives, said Carmignac investment committee member Kevin Thozet.

That makes the outcome of the legislative elections almost as important as who wins the presidency.

“Once April 24th is over, investors should certainly and very quickly follow very closely this ‘third round’ of the French presidential election,” Thozet said.

(Reporting by Dhara Ranasinghe in London and Leigh Thomas in Paris; Editing by Nick Macfie)

About the Author

Reuterscontributor

Reuters, the news and media division of Thomson Reuters, is the world’s largest international multimedia news provider reaching more than one billion people every day. Reuters provides trusted business, financial, national, and international news to professionals via Thomson Reuters desktops, the world's media organizations, and directly to consumers at Reuters.com and via Reuters TV. Learn more about Thomson Reuters products:

Did you find this article useful?

Latest news and analysis

Advertisement