Advertisement

Advertisement

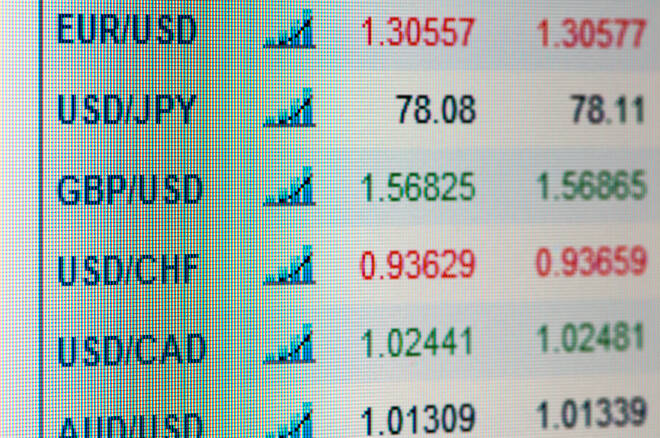

Private Sector PMIs and Brexit Put the EUR, the Pound, and the Dollar in Focus

By:

It's a busy day ahead, with private sector PMI numbers in focus. Brexit, COVID-19, and U.S stimulus package updates will also influence.

Earlier in the Day:

It’s was a relatively quiet start to the day on the economic calendar this morning. The Kiwi Dollar was in action in the early part of the day.

For the Kiwi Dollar

Retail sales jumped by 28% in the 3rd quarter, reversing a 14.6% slide from the 2nd quarter. This was the largest quarterly rise since records began.

According to NZ Stats,

- Year-on-year, retail sales rose by 7.4%, partially reversing a 15% slump from the 2nd

- Spending on major household items, vehicles, and groceries supported the 7.4% rise in total sales compared with September 2019.

- Motor vehicles and parts retailing had the largest rise in sales, up 13%. Supermarket and grocery store sales rose by 8.4%.

The Kiwi Dollar moved from $0.69321 to $0.69249 upon release of the data. At the time of writing, the Kiwi Dollar was up by 0.16% to $0.6940.

Elsewhere

At the time of writing, the Japanese Yen up by 0.02% to ¥103.84 against the U.S Dollar, with, the Aussie Dollar up by 0.07% to $0.7307.

The Day Ahead:

For the EUR

It’s a busy day ahead on the economic calendar. Prelim private sector PMI numbers for November for France, Germany, and the Eurozone are due out later today.

With parts of the EU back in lockdown mode, expect plenty of sensitivity to the numbers. The ECB has assured of support next month, today’s numbers could give an idea of what kind of support to expect.

At the time of writing, the EUR was up by 0.03% to $1.1861.

For the Pound

It’s a relatively busy day ahead on the economic calendar. Prelim private sector PMI numbers for November are due out.

With lockdown measures in place from the start of the month, today’s figures could force the BoE’s hand in delivering negative rates…

Away from the economic calendar, Brexit will continue to be a key area of focus. From the weekend, news of a post-Brexit trade agreement with Canada should provide some early support.

At the time of writing, the Pound was up by 0.19% to $1.3300.

Across the Pond

It’s also a relatively busy day ahead for the U.S Dollar. November’s prelim private sector PMIs are due out. With labor market conditions in dire straits as a result of containment measures in place, service sector activity will be the main focal point.

Away from the economic calendar, chatter from Capitol Hill and COVID-19 news updates will remain key drivers.

At the time of writing, the Dollar Spot Index was down by 0.03% to 92.360.

For the Loonie

It’s a quiet day on the economic data front. There are no material stats due out to provide the Loonie with direction.

The lack of stats will leave the Loonie in the hands of PMI numbers from the U.S and the EU and COVID-19 news updates.

At the time of writing, the Loonie was up by 0.05% to C$1.3089 against the U.S Dollar.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement