Advertisement

Advertisement

Risk Appetite Weighs on the Dollar, with COVID-19 and Geopolitics in Focus today

By:

Riskier assets find support early on. There are no material stats to influence today, however, leaving COVID-19 and geopolitics in focus.

Earlier in the Day:

It’s was a particularly quiet start to the day on the economic calendar this morning. There were no material stats to provide direction through the Asian session, leaving the markets to take their cues from the U.S. session on Friday.

Support for riskier assets weighed on the Dollar early, driving support for the commodity currencies and the Yen.

For the Majors

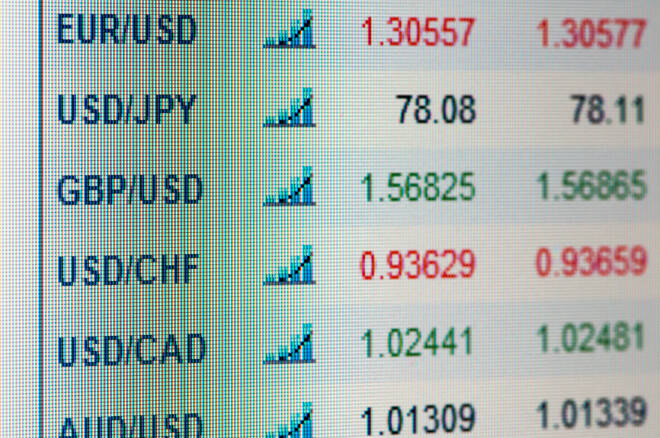

At the time of writing, the Japanese Yen was up by 0.19% ¥105.38 against the U.S Dollar. The Aussie Dollar was up by 0.34% to $0.7055, with the Kiwi Dollar up by 0.20% to $0.6559.

The Day Ahead:

For the EUR

It’s a quiet day ahead on the economic calendar. There are no material stats due out of the Eurozone to provide the EUR with direction.

While there are no material stats to consider, ECB President Lagarde is scheduled to speak late in the day. Any monetary policy chatter will influence.

Away from the economic calendar, COVID-19 and geopolitics remain key drivers. From the weekend and late last week, there was nothing positive on the COVID-19 vaccine front to ease concerns over the latest spike in new cases.

At the time of writing, the EUR was up by 0.03% to $1.1635.

For the Pound

It’s also a quiet day ahead on the economic calendar. There are no material stats due out to provide the Pound with direction.

The lack of stats will leave the Pound in the hands of Brexit and COVID-19 on the day.

COVID-19 news suggests that the government may be forced to deliver more measures to contain the spread.

On the Brexit front, 3-days of talks are set to begin on Tuesday. Progress will need to be made for more intense talks to then be held on key hurdles ahead of the EU Summit in mid-October.

At the time of writing, the Pound was up by 0.15% to $1.2765.

Across the Pond

It’s a quiet day ahead for the U.S Dollar. There are no material stats due out of the U.S to provide the Dollar with direction.

A lack of stats leaves the Dollar in the hands of geopolitics and COVID-19 news updates.

From late last week, U.S sanctions on SMIC and a court ruling on Trump’s ban on TikTok will set the tone. The court ruling to block Trump’s attempts to ban TikTok was well received.

The Dollar Spot Index was down by 0.14% to 94.514 at the time of writing.

For the Loonie

It’s another particularly quiet day ahead, with no material stats due out today.

The lack of stats will leave the Loonie in the hands of market risk sentiment and crude oil prices.

Key areas of focus remain U.S – China relations and COVID-19. From the weekend, news of a spike in new cases across Ontario and Quebec will be Loonie negative.

At the time of writing, the Loonie was up by 0.03% to C$1.3382 against the U.S Dollar.

For a look at all of today’s economic events, check out our economic calendar.

About the Author

Bob Masonauthor

With over 28 years of experience in the financial industry, Bob has worked with various global rating agencies and multinational banks. Currently he is covering currencies, commodities, alternative asset classes and global equities, focusing mostly on European and Asian markets.

Advertisement