Advertisement

Advertisement

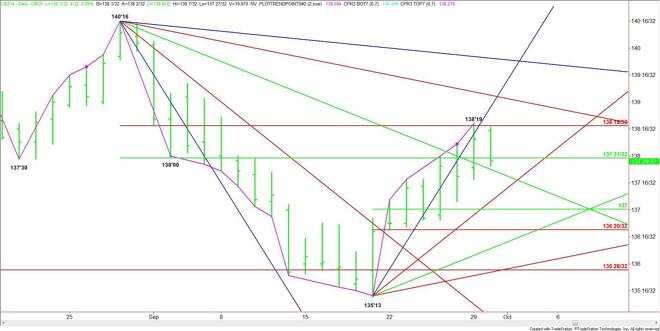

30-Yr U.S. Treasury Bonds (US) Futures Technical Analysis – October 1, 2014 Forecast

By:

December 30-Year U.S. Treasury Bonds posted an inside day, lower-close on Tuesday, giving the market a downside bias and indicating impending volatility.

December 30-Year U.S. Treasury Bonds posted an inside day, lower-close on Tuesday, giving the market a downside bias and indicating impending volatility.

The main range is 140’16 to 135’13. Its retracement zone at 137’31 to 138’18 is stopping the current rally. On Monday, the market reached a top at 138’19, close to the upper or Fibonacci level. Yesterday’s close was below the 50% level at 137’31, suggesting downside momentum for Wednesday.

Crossing to the bearish side of a downtrending angle at 137’20 will be another sign of weakness. This could trigger a break into the steep uptrending angle at 137’13.

The short-term range is 135’13 to 138’19. Its retracement zone at 137’00 to 136’20 is the main downside target. This is followed by an uptrending angle at 136’13.

The tone of the market today will likely be determined by trader reaction to the 50% level at 137’31. Holding above it may indicate traders will take another shot at breaking out over the recent high at 138’19. A sustained move below the 50% level will likely encourage more selling pressure with the main target 137’00 to 136’20.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement