Advertisement

Advertisement

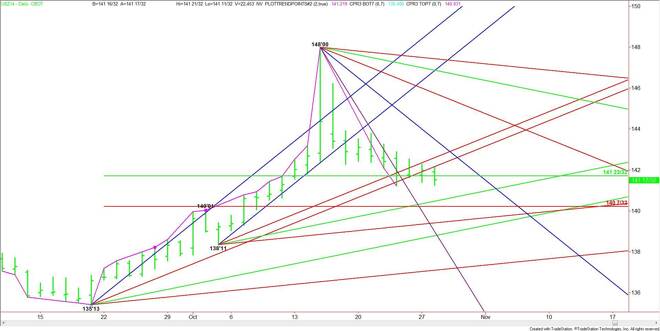

30-Yr U.S. Treasury Bonds (US) Futures Technical Analysis – October 29, 2014 Forecast

By:

December 30-Year U.S. Treasury Bonds consolidated for a third day on Tuesday while straddling a major 50% level at 141’23. Trader reaction to this price

December 30-Year U.S. Treasury Bonds consolidated for a third day on Tuesday while straddling a major 50% level at 141’23. Trader reaction to this price will set the tone for the day. Trader indecision before today’s Fed statement was the reason behind the tight trading range.

The Fed is expected to announce the end to its quantitative easing program and leave interest rates unchanged. It’s not what the Fed is going to do that is important today, but what it says in the statement. Topics that may be mentioned include the effects of the weak Euro Zone economy on the U.S. recovery, the impact of the strong U.S. Dollar on the economy and falling energy prices as they pertain to inflation.

If sellers come in at 141’23 then look for them to target an uptrending angle at 140’19 a Fibonacci level at 140’07. This is followed by a pair of uptrending angles at 139’15 and 138’29.

Holding 141’23 will be a sign that buyers are coming in to support the market, but don’t expect a rally until the pair of uptrending angles at 142’13 and 142’27 are overtaken. This action could trigger a move into a steep downtrending angle at 143’00.

The T-Bond chart opens up over 143’00. A sustained move through this angle could generate enough upside momentum to challenge the next downtrending angle at 145’16.

Look for increased volatility, following the release of the Fed statement at 2:00 pm EDT. If buying strength or selling weakness, make sure you have volume on your side. A dovish statement by the Fed will be bullish for T-Bonds. This should trigger a rally through 141’23. A hawkish statement should lead to a break under 141’23.

About the Author

James Hyerczykauthor

James Hyerczyk is a U.S. based seasoned technical analyst and educator with over 40 years of experience in market analysis and trading, specializing in chart patterns and price movement. He is the author of two books on technical analysis and has a background in both futures and stock markets.

Advertisement