Advertisement

Advertisement

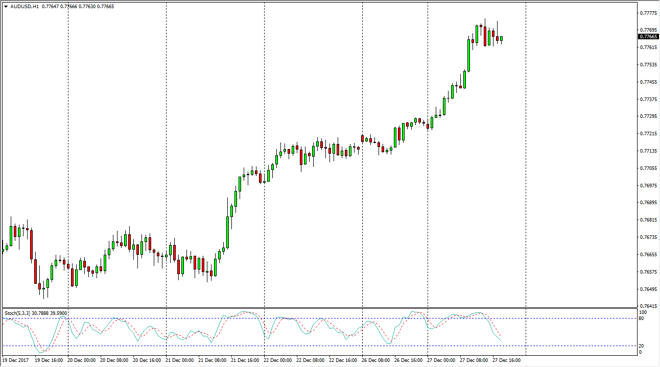

AUD/USD Price Forecast December 28, 2017, Technical Analysis

Updated: Dec 28, 2017, 05:00 GMT+00:00

The Australian dollar rallied a bit during the trading session on Wednesday, as we continue to see a lot of noise. Gold markets rallied a bit, so that of course helps the Australian dollars well. I think pullbacks will offer buying opportunities, but if we were to break down below the 0.77 handle, it would be very negative.

The Australian dollar rallied a bit during the trading session during the day on Wednesday, reaching towards the 0.7775 level. I think the 0.78 level above is resistance, but the real resistance is probably found closer to the 0.80 level. At that area, we have a significant amount of importance based upon longer-term charts. The 0.80 level was essentially “fair value” longer term. I think that the market breaking above there should be a very bullish sign, and should send the Australian dollar much higher.

Beyond that, the market should continue to be very choppy, but keep in mind that the Australian dollar is very sensitive to the overall risk appetite, so if that’s the case, it’s likely that the stock markets will have an influence as well. Longer-term, we could go as high as 0.90, but that obviously will take a while to get to. On the other, if we break down below the 0.77 handle, the market probably goes down to the 0.75 handle, an area that should be massively supportive. A breakdown below there would be catastrophic. Longer-term, I still believe that the Australian dollar is cheap, and that if we get more of a “risk on” attitude globally, and especially if we can get gains in construction in China, then the Aussie will benefit as it typically does being a proxy for China and of course the construction boom.

AUD/USD Video 28.12.17

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement