Advertisement

Advertisement

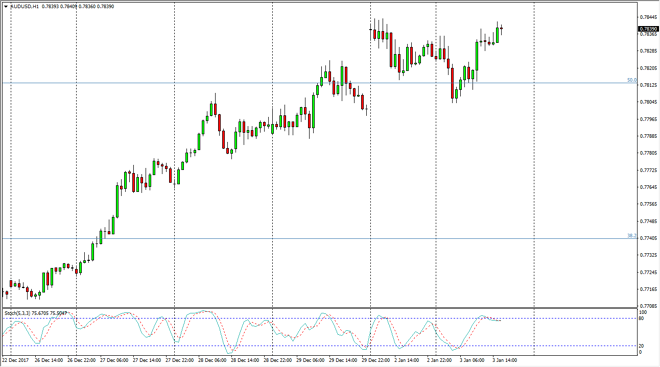

AUD/USD Price Forecast January 4, 2017, Technical Analysis

Updated: Jan 4, 2018, 07:17 GMT+00:00

The Australian dollar initially fell during trading on Wednesday, but found enough support near the 0.78 level, the scene of a gap previously, to turn around and rally.

The Australian dollar pulled back during the trading session on Wednesday, filling the gap from the Tuesday session. I believe that the market should continue to go higher, perhaps reaching towards the 0.79 level above, and then perhaps even the 0.80 level after that. That’s an area that should be very important, as it has been a fulcrum for longer-term trading going back decades. If we can break above the 0.80 level, the market should continue to go towards much higher levels, and put us into a “buy-and-hold” scenario. Alternately, if we were to break down from here I think we will probably go looking towards the 0.77 handle, and then the 0.75 level which will be massively supportive.

Pay attention to the gold markets, because they of course have a massive influence on the Australian dollar, moving in the same direction over the longer term. I believe that the market rallying from here should continue to offer buying opportunities on dips, as the US dollar is getting pummeled and it looks likely that the trend continues going into the year. Ultimately, I think that the markets will not only break the 0.80 level, but I think this is the beginning of a larger move over the next couple of years.

If we did breakdown from here, we could reach towards the 0.75 handle, and that of course is a major round number. If we were to break down below that, it would be catastrophic for the Australian dollar and could send the market into a bit of a tailspin. I don’t expect that to happen, but it is the other side of what’s going on.

AUD/USD Video 03.01.18

About the Author

Christopher Lewisauthor

Chris is a proprietary trader with more than 20 years of experience across various markets, including currencies, indices and commodities. As a senior analyst at FXEmpire since the website’s early days, he offers readers advanced market perspectives to navigate today’s financial landscape with confidence.

Advertisement